Page 144 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 144

Financial Accounting-I

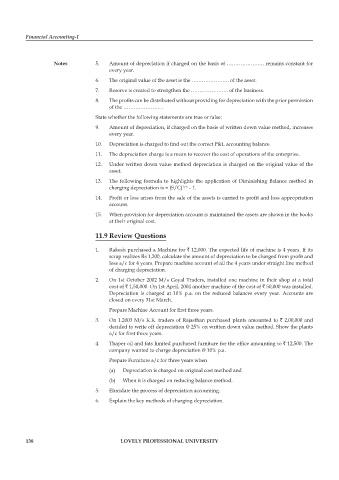

Notes 5. Amount of depreciation if charged on the basis of …………………. remains constant for

every year.

6. The original value of the asset is the …………………. of the asset.

7. Reserve is created to strengthen the …………………. of the business.

8. The profits can be distributed without providing for depreciation with the prior permission

of the …………………. .

State whether the following statements are true or false:

9. Amount of depreciation, if charged on the basis of written down value method, increases

every year.

10. Depreciation is charged to find out the correct P&L accounting balance.

11. The depreciation charge is a mean to recover the cost of operations of the enterprise.

12. Under written down value method depreciation is charged on the original value of the

asset.

13. The following formula to highlights the application of Diminishing Balance method in

charging depreciation is = (S/C) – 1.

1/n

14. Profit or loss arises from the sale of the assets is carried to profit and loss appropriation

account.

15. When provision for depreciation account is maintained the assets are shown in the books

at their original cost.

11.9 Review Questions

1. Rakesh purchased a Machine for ` 12,000. The expected life of machine is 4 years. If its

scrap realizes Rs 1,200, calculate the amount of depreciation to be charged from profi t and

loss a/c for 4 years. Prepare machine account of all the 4 years under straight line method

of charging depreciation.

2. On 1st October 2002 M/s Goyal Traders, installed one machine in their shop at a total

cost of ` 1,50,000. On 1st April, 2004 another machine of the cost of ` 50,000 was installed.

Depreciation is charged at 10% p.a. on the reduced balances every year. Accounts are

closed on every 31st March.

Prepare Machine Account for first three years.

3. On 1.2003 M/s K.K. traders of Rajasthan purchased plants amounted to ` 2,00,000 and

decided to write off depreciation @ 25% on written down value method. Show the plants

a/c for first three years.

4. Thaper oil and fats limited purchased furniture for the office amounting to ` 12,500. The

company wanted to charge depreciation @ 10% p.a.

Prepare Furniture a/c for three years when

(a) Depreciation is charged on original cost method and

(b) When it is charged on reducing balance method.

5. Elucidate the process of depreciation accounting.

6. Explain the key methods of charging depreciation.

138 LOVELY PROFESSIONAL UNIVERSITY