Page 140 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 140

Financial Accounting-I

Notes

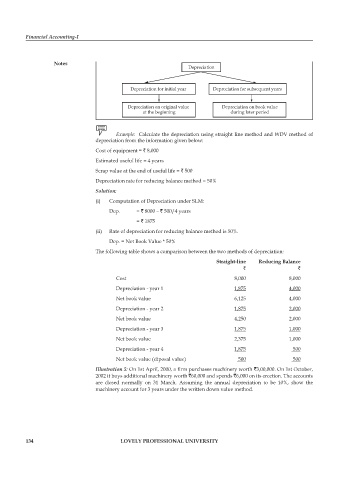

Depreciation

Depreciation for initial year Depreciation for subsequent years

Depreciation on original value Depreciation on book value

at the beginning during later period

Example: Calculate the depreciation using straight line method and WDV method of

depreciation from the information given below:

Cost of equipment = ` 8,000

Estimated useful life = 4 years

Scrap value at the end of useful life = ` 500

Depreciation rate for reducing balance method = 50%

Solution:

(i) Computation of Depreciation under SLM:

Dep. = ` 8000 – ` 500/4 years

= ` 1875

(ii) Rate of depreciation for reducing balance method is 50%.

Dep. = Net Book Value * 50%

The following table shows a comparison between the two methods of depreciation:

Straight-line Reducing Balance

` `

Cost 8,000 8,000

Depreciation - year 1 1,875 4,000

Net book value 6,125 4,000

Depreciation - year 2 1,875 2,000

Net book value 4,250 2,000

Depreciation - year 3 1,875 1,000

Net book value 2,375 1,000

Depreciation - year 4 1,875 500

Net book value (diposal value) 500 500

Illustration 5: On 1st April, 2000, a firm purchases machinery worth `3,00,000. On 1st October,

2002 it buys additional machinery worth `60,000 and spends `6,000 on its erection. The accounts

are closed normally on 31 March. Assuming the annual depreciation to be 10%, show the

machinery account for 3 years under the written down value method.

134 LOVELY PROFESSIONAL UNIVERSITY