Page 137 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 137

Unit 11: Depreciation Accounting

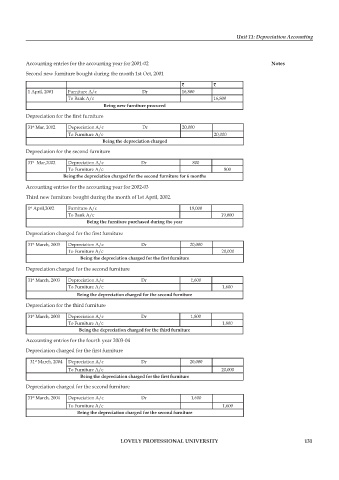

Accounting entries for the accounting year for 2001-02 Notes

Second new furniture bought during the month 1st Oct, 2001

` `

1 April, 2001 Furniture A/c Dr 16,800

To Bank A/c 16,800

Being new furniture procured

Depreciation for the fi rst furniture

31 Mar, 2002 Depreciation A/c Dr 20,000

st

To Furniture A/c 20,000

Being the depreciation charged

Depreciation for the second furniture

31 Mar,2002 Depreciation A/c Dr 800

st

To Furniture A/c 800

Being the depreciation charged for the second furniture for 6 months

Accounting entries for the accounting year for 2002-03

Third new furniture bought during the month of 1st April, 2002.

1 April,2002 Furniture A/c 19,000

st

To Bank A/c 19,000

Being the furniture purchased during the year

Depreciation charged for the fi rst furniture

31 March, 2003 Depreciation A/c Dr 20,000

st

To Furniture A/c 20,000

Being the depreciation charged for the fi rst furniture

Depreciation charged for the second furniture

st

31 March, 2003 Depreciation A/c Dr 1,600

To Furniture A/c 1,600

Being the depreciation charged for the second furniture

Depreciation for the third furniture

31 March, 2003 Depreciation A/c Dr 1,800

st

To Furniture A/c 1,800

Being the depreciation charged for the third furniture

Accounting entries for the fourth year 2003-04

Depreciation charged for the fi rst furniture

31 March, 2004 Depreciation A/c Dr 20,000

st

To Furniture A/c 20,000

Being the depreciation charged for the fi rst furniture

Depreciation charged for the second furniture

st

31 March, 2004 Depreciation A/c Dr 1,600

To Furniture A/c 1,600

Being the depreciation charged for the second furniture

LOVELY PROFESSIONAL UNIVERSITY 131