Page 134 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 134

Financial Accounting-I

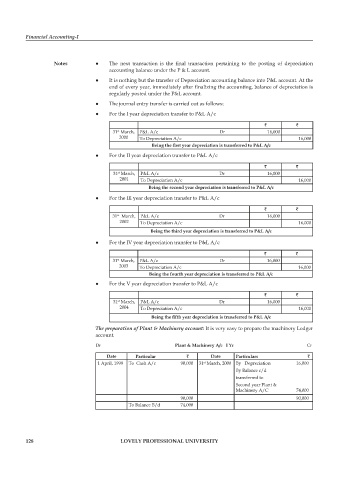

Notes z The next transaction is the final transaction pertaining to the posting of depreciation

accounting balance under the P & L account.

z It is nothing but the transfer of Depreciation accounting balance into P&L account. At the

end of every year, immediately after finalizing the accounting, balance of depreciation is

regularly posted under the P&L account.

z The journal entry transfer is carried out as follows:

z For the I year depreciation transfer to P&L A/c

` `

31 March, P&L A/c Dr 16,000

st

2000 To Depreciation A/c 16,000

Being the first year depreciation is transferred to P&L A/c

z For the II year depreciation transfer to P&L A/c

` `

31 March, P&L A/c Dr 16,000

st

2001 To Depreciation A/c 16,000

Being the second year depreciation is transferred to P&L A/c

z For the III year depreciation transfer to P&L A/c

` `

31 March, P&L A/c Dr 16,000

st

2002 To Depreciation A/c 16,000

Being the third year depreciation is transferred to P&L A/c

z For the IV year depreciation transfer to P&L A/c

` `

31 March, P&L A/c Dr 16,000

st

2003 To Depreciation A/c 16,000

Being the fourth year depreciation is transferred to P&L A/c

z For the V year depreciation transfer to P&L A/c

` `

31 March, P&L A/c Dr 16,000

st

2004 To Depreciation A/c 16,000

Being the fifth year depreciation is transferred to P&L A/c

The preparation of Plant & Machinery account: It is very easy to prepare the machinery Ledger

account.

Dr Plant & Machinery A/c I Yr Cr

Date Particular ` Date Particulars `

1 April, 1999 To Cash A/c 90,000 31 March, 2000 By Depreciation 16,000

st

By Balance c/d

transferred to

Second year Plant &

Machinery A/C 74,000

90,000 90,000

To Balance B/d 74,000

128 LOVELY PROFESSIONAL UNIVERSITY