Page 135 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 135

Unit 11: Depreciation Accounting

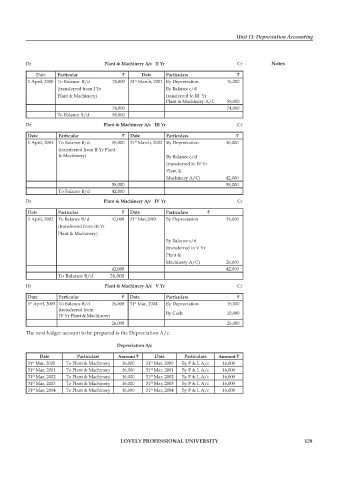

Dr Plant & Machinery A/c II Yr Cr Notes

Date Particular ` Date Particulars `

1 April, 2000 To Balance B/d 74,000 31 March, 2001 By Depreciation 16,000

st

(transferred from I Yr By Balance c/d

Plant & Machinery) transferred to III Yr

Plant & Machinery A/C 58,000

74,000 74,000

To Balance B/d 58,000

Dr Plant & Machinery A/c III Yr Cr

Date Particular ` Date Particulars `

1 April, 2001 To Balance B/d 58,000 31 March, 2002 By Depreciation 16,000

st

(transferred from II Yr Plant

& Machinery) By Balance c/d

(transferred to IV Yr

Plant &

Machinery A/C) 42,000

58,000 58,000

To Balance B/d 42,000

Dr Plant & Machinery A/c IV Yr Cr

Date Particular ` Date Particulars `

st

1 April, 2002 To Balance B/d 42,000 31 Mar,2003 By Depreciation 16,000

(transferred from III Yr

Plant & Machinery)

By Balance c/d

(transferred to V Yr

Plant &

Machinery A/C) 26,000

42,000 42,000

To Balance B/d 26,000

Dr Plant & Machinery A/c V Yr Cr

Date Particular ` Date Particulars `

st

1 April, 2003 To Balance B/d 26,000 31 Mar, 2004 By Depreciation 16,000

st

(transferred from

IV Yr Plant & Machinery) By Cash 10,000

26,000 26,000

The next ledger account to be prepared is the Depreciation A/c.

Depreciation A/c

Date Particulars Amount ` Date Particulars Amount `

31 Mar, 2000 To Plant & Machinery 16,000 31 Mar, 2000 By P & L A/c 16,000

st

st

31 Mar, 2001 To Plant & Machinery 16,000 31 Mar, 2001 By P & L A/c 16,000

St

St

St

31 Mar, 2002 To Plant & Machinery 16,000 31 Mar, 2002 By P & L A/c 16,000

St

31 Mar, 2003 To Plant & Machinery 16,000 31 Mar, 2003 By P & L A/c 16,000

St

St

31 Mar, 2004 To Plant & Machinery 16,000 31 Mar, 2004 By P & L A/c 16,000

St

St

LOVELY PROFESSIONAL UNIVERSITY 129