Page 136 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 136

Financial Accounting-I

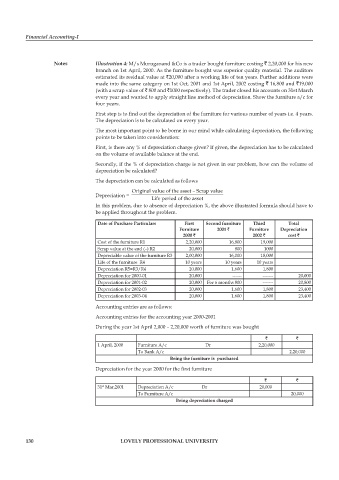

Notes Illustration 4: M/s Muruganand &Co is a trader bought furniture costing ` 2,20,000 for his new

branch on 1st April, 2000. As the furniture bought was superior quality material. The auditors

estimated its residual value at `20,000 after a working life of ten years. Further additions were

made into the same category on 1st Oct, 2001 and 1st April, 2002 costing ` 16,800 and `19,000

(with a scrap value of ` 800 and `1000 respectively). The trader closed his accounts on 31st March

every year and wanted to apply straight line method of depreciation. Show the furniture a/c for

four years.

First step is to find out the depreciation of the furniture for various number of years i.e. 4 years.

The depreciation is to be calculated on every year.

The most important point to be borne in our mind while calculating depreciation, the following

points to be taken into consideration:

First, is there any % of depreciation charge given? If given, the depreciation has to be calculated

on the volume of available balance at the end.

Secondly, if the % of depreciation charge is not given in our problem, how can the volume of

depreciation be calculated?

The depreciation can be calculated as follows

Original value of the asset – Scrap value

Depreciation =

Life period of the asset

In this problem, due to absence of depreciation %, the above illustrated formula should have to

be applied throughout the problem.

Date of Purchase Particulars First Second furniture Third Total

Furniture 2001 ` Furniture Depreciation

2000 ` 2002 ` cost `

Cost of the furniture R1 2,20,000 16,800 19,000

Scrap value at the end (–) R2 20,000 800 1000

Depreciable value of the furniture R3 2,00,000 16,000 18,000

Life of the furniture R4 10 years 10 years 10 years

Depreciation R5=R3/R4 20,000 1,600 1,800

Depreciation for 2000-01 20,000 ------ ------- 20,000

Depreciation for 2001-02 20,000 For 6 months 800 ------- 20,800

Depreciation for 2002-03 20,000 1,600 1,800 23,400

Depreciation for 2003-04 20,000 1,600 1,800 23,400

Accounting entries are as follows:

Accounting entries for the accounting year 2000-2001

During the year 1st April 2,000 – 2,20,000 worth of furniture was bought

` `

1 April, 2000 Furniture A/c Dr 2,20,000

To Bank A/c 2,20,000

Being the furniture is purchased

Depreciation for the year 2000 for the fi rst furniture

` `

31 Mar,2001 Depreciation A/c Dr 20,000

st

To Furniture A/c 20,000

Being depreciation charged

130 LOVELY PROFESSIONAL UNIVERSITY