Page 133 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 133

Unit 11: Depreciation Accounting

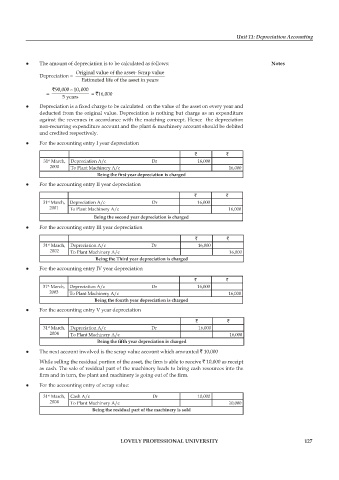

z The amount of depreciation is to be calculated as follows: Notes

Original value of the asset- Scrap value

Depreciation =

Estimated life of the asset in years

` 90,000 – 10,000

= = `16,000

5 years

z Depreciation is a fixed charge to be calculated on the value of the asset on every year and

deducted from the original value. Depreciation is nothing but charge as an expenditure

against the revenues in accordance with the matching concept. Hence the depreciation

non-recurring expenditure account and the plant & machinery account should be debited

and credited respectively.

z For the accounting entry I year depreciation

` `

st

31 March, Depreciation A/c Dr 16,000

2000 To Plant Machinery A/c 16,000

Being the first year depreciation is charged

z For the accounting entry II year depreciation

` `

31 March, Depreciation A/c Dr 16,000

st

2001 To Plant Machinery A/c 16,000

Being the second year depreciation is charged

z For the accounting entry III year depreciation

` `

st

31 March, Depreciation A/c Dr 16,000

2002 To Plant Machinery A/c 16,000

Being the Third year depreciation is charged

z For the accounting entry IV year depreciation

` `

st

31 March, Depreciation A/c Dr 16,000

2003 To Plant Machinery A/c 16,000

Being the fourth year depreciation is charged

z For the accounting entry V year depreciation

` `

31 March, Depreciation A/c Dr 16,000

st

2004 To Plant Machinery A/c 16,000

Being the fifth year depreciation is charged

z The next account involved is the scrap value account which amounted ` 10,000

While selling the residual portion of the asset, the firm is able to receive ` 10,000 as receipt

as cash. The sale of residual part of the machinery leads to bring cash resources into the

firm and in turn, the plant and machinery is going out of the fi rm.

z For the accounting entry of scrap value:

31 March, Cash A/c Dr 10,000

st

2004 To Plant Machinery A/c 10,000

Being the residual part of the machinery is sold

LOVELY PROFESSIONAL UNIVERSITY 127