Page 82 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 82

Financial Accounting-I

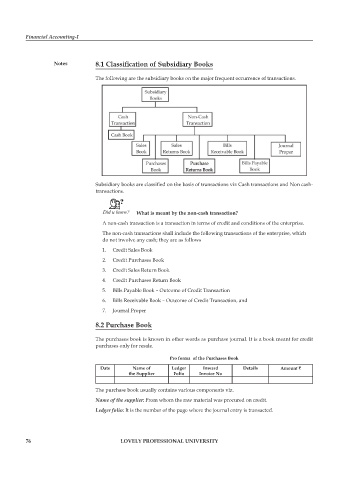

Notes 8.1 Classification of Subsidiary Books

The following are the subsidiary books on the major frequent occurrence of transactions.

Subsidiary books are classified on the basis of transactions viz Cash transactions and Non cash-

transactions.

?

Did u know? What is meant by the non-cash transaction?

A non-cash transaction is a transaction in terms of credit and conditions of the enterprise.

The non-cash transactions shall include the following transactions of the enterprise, which

do not involve any cash; they are as follows

1. Credit Sales Book

2. Credit Purchases Book

3. Credit Sales Return Book

4. Credit Purchases Return Book

5. Bills Payable Book – Outcome of Credit Transaction

6. Bills Receivable Book – Outcome of Credit Transaction, and

7. Journal Proper

8.2 Purchase Book

The purchases book is known in other words as purchase journal. It is a book meant for credit

purchases only for resale.

Pro forma of the Purchases Book

Date Name of Ledger Inward Details Amount `

the Supplier Folio Invoice No

The purchase book usually contains various components viz.

Name of the supplier: From whom the raw material was procured on credit.

Ledger folio: It is the number of the page where the journal entry is transacted.

76 LOVELY PROFESSIONAL UNIVERSITY