Page 97 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 97

Unit 8: Subsidiary Books

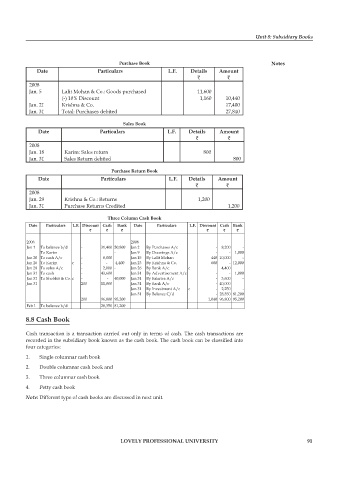

Purchase Book Notes

Date Particulars L.F. Details Amount

` `

2008

Jan. 5 Lalit Mohan & Co.: Goods purchased 11,600

(-) 10% Discount 1,160 10,440

Jan. 21 Krishna & Co. 17,400

Jan. 31 Total: Purchases debited 27,840

Sales Book

Date Particulars L.F. Details Amount

` `

2008

Jan. 18 Karim: Sales return 800

Jan. 31 Sales Return debited 800

Purchase Return Book

Date Particulars L.F. Details Amount

` `

2008

Jan. 29 Krishna & Co.: Returns 1,200

Jan. 31 Purchase Returns Credited 1,200

Three Column Cash Book

Date Particulars L.F. Discount Cash Bank Date Particulars L.F. Discount Cash Bank

` ` ` ` ` `

2008 2008

Jan 1 To balance b/d - 31,400 50,800 Jan 2 By Purchases A/c - 8,200 -

To Karim - Jan 9 By Drawings A/c - - 1,000

Jan 20 To cash A/c - 8,000 Jan 15 By Lalit Mohan 440 10,000 -

Jan 26 To Karim c - - 4,400 Jan 23 By Krishna & Co. 600 - 12,000

Jan 28 To sales A/c - 2,000 - Jan 26 By Bank A/c c 4,400

Jan 31 To cash - 43,600 Jan 31 By Advertisement A/c - - 1,000

Jan 31 To Shobhit & Co. c - - 40,000 Jan 31 By Salaries A/c - 3,600 -

Jan 31 200 11,800 Jan 31 By Bank A/c - 40,000

Jan 31 By Investment A/c c - 2,250 -

Jan 31 By Balance C/d - 28,350 81,200

200 96,800 95,200 1,040 96,800 95,200

Feb 1 To balance b/d 28,350 81,200

8.8 Cash Book

Cash transaction is a transaction carried out only in terms of cash. The cash transactions are

recorded in the subsidiary book known as the cash book. The cash book can be classifi ed into

four categories:

1. Single columnar cash book

2. Double columnar cash book and

3. Three columnar cash book

4. Petty cash book

Note: Different type of cash books are discussed in next unit.

LOVELY PROFESSIONAL UNIVERSITY 91