Page 162 - DCOM106_COMPANY_LAW

P. 162

Unit 10: Management of Company

10.6.2 Increase in Remuneration Notes

Section 310 provides that every increase in the remuneration of any director including a managing

or whole-time director granted or provided by any amendment in his term of appointment

which has the effect of increasing, whether directly or indirectly, the amount payable to him

would not be operative unless the same has been approved by the Central Government. But no

approval of the Central Government would be required if the increase in remuneration made is

in accordance with the conditions specified in Schedule XIII. Also no approval of the Central

Government is necessary, if the increase in the remuneration is only by way of fee for each

meeting of the Board or a committee of the Board attended by any such director and the amount

of the fee after such increase does not exceed such sum as may be prescribed. The Central

Government has laid down differential scale of sitting fee according to the paid-up capital of the

companies.

10.7 Remuneration Payable to a Manager

Section 387 provides that he may receive remuneration either by way of a monthly payment or

by way of a specified percentage of the ‘net profits’ of the company, or partly by one way and

partly by the other. Such remuneration, however, must not exceed in the aggregate 5 per cent of

the net profits except with the approval of the Central Government.

10.7.1 Managerial Remuneration vis-à-vis Schedule XIII

A public company is entitled to appoint its managerial personnel and fix their remuneration so

long as the same is in accordance with the conditions laid down in Schedule XIII without seeking

the prior approval of the Central Government. Schedule XIII, provides as follows:

1. Remuneration Payable by Companies Having Profits: Subject to the provisions of s.198

and s.309, a company having profits in a financial year may pay any remuneration, by way

of salary, dearness allowance, perquisites, commission and other allowances, which shall

not exceed 5 per cent of its net profits for one such managerial person and if there are more

than one such managerial persons, 10 per cent for all of them together.

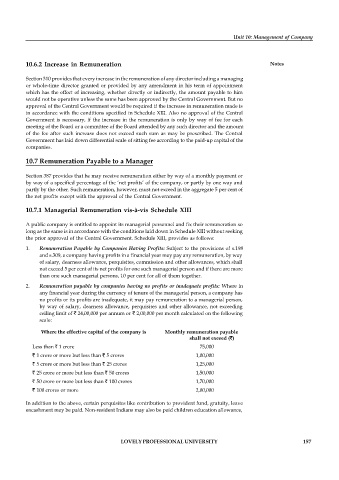

2. Remuneration payable by companies having no profits or inadequate profits: Where in

any financial year during the currency of tenure of the managerial person, a company has

no profits or its profits are inadequate, it may pay remuneration to a managerial person,

by way of salary, dearness allowance, perquisites and other allowance, not exceeding

ceiling limit of 24,00,000 per annum or 2,00,000 per month calculated on the following

scale:

Where the effective capital of the company is Monthly remuneration payable

shall not exceed ( )

Less than 1 crore 75,000

1 crore or more but less than 5 crores 1,00,000

5 crore or more but less than 25 crores 1,25,000

25 crore or more but less than 50 crores 1,50,000

50 crore or more but less than 100 crores 1,70,000

100 crores or more 2,00,000

In addition to the above, certain perquisites like contribution to provident fund, gratuity, leave

encashment may be paid. Non-resident Indians may also be paid children education allowance,

LOVELY PROFESSIONAL UNIVERSITY 157