Page 139 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 139

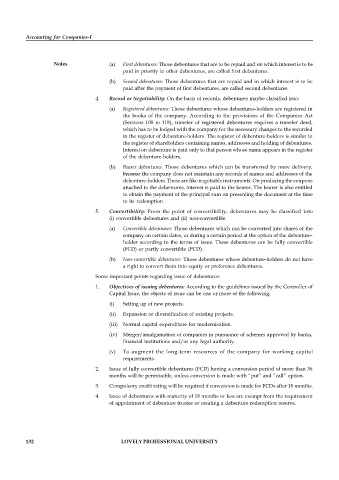

Accounting for Companies-I

Notes (a) First debentures: Those debentures that are to be repaid and on which interest is to be

paid in priority to other debentures, are called first debentures.

(b) Second debentures: Those debentures that are repaid and in which interest is to be

paid after the payment of first debentures, are called second debentures.

4. Record or Negotiability: On the basis of records, debentures maybe classified into:

(a) Registered debentures: Those debentures whose debentures-holders are registered in

the books of the company. According to the provisions of the Companies Act

(Sections 108 to 118), transfer of registered debentures requires a transfer deed,

which has to be lodged with the company for the necessary changes to the recorded

in the register of debenture-holders. The register of debenture-holders is similar to

the register of shareholders containing names, addresses and holding of debentures.

Interest on debenture is paid only to that person whose name appears in the register

of the debenture-holders.

(b) Bearer debentures: Those debentures which can be transferred by mere delivery,

because the company does not maintain any records of names and addresses of the

debenture-holders. These are like negotiable instruments. On producing the coupons

attached to the debentures, interest is paid to the bearer. The bearer is also entitled

to obtain the payment of the principal sum on presenting the document at the time

to its redemption.

5. Convertibility: From the point of convertibility, debentures may be classified into

(i) convertible debentures and (ii) non-convertible.

(a) Convertible debentures: Those debentures which can be converted into shares of the

company on certain dates, or during a certain period at the option of the debenture-

holder according to the terms of issue. These debentures can be fully convertible

(FCD) or partly convertible (PCD).

(b) Non-convertible debentures: Those debentures whose debenture-holders do not have

a right to convert them into equity or preference debentures.

Some important points regarding issue of debentures:

1. Objectives of issuing debentures: According to the guidelines issued by the Controller of

Capital Issue, the objects of issue can be one or more of the following:

(i) Setting up of new projects.

(ii) Expansion or diversification of existing projects.

(iii) Normal capital expenditure for modernisation.

(iv) Merger/amalgamation of companies in pursuance of schemes approved by banks,

financial institutions and/or any legal authority.

(v) To augment the long-term resources of the company for working capital

requirements.

2. Issue of fully convertible debentures (FCD) having a conversion period of more than 36

months will be permissible, unless conversion is made with “put” and “call” option.

3. Compulsory credit rating will be required if conversion is made for FCDs after 18 months.

4. Issue of debentures with maturity of 18 months or less are exempt from the requirement

of appointment of debenture trustee or creating a debenture redemption reserve.

132 LOVELY PROFESSIONAL UNIVERSITY