Page 16 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 16

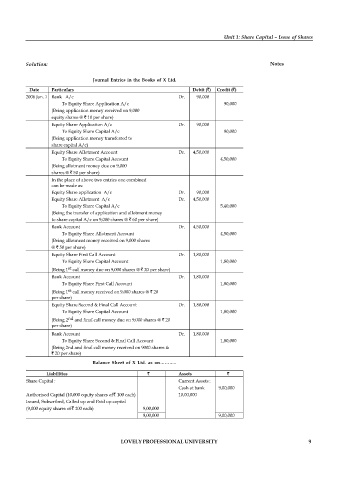

Unit 1: Share Capital – Issue of Shares

Solution: Notes

Journal Entries in the Books of X Ltd.

Date Particulars Debit (`) Credit (`)

2006 Jan. 1 Bank A/c Dr. 90,000

To Equity Share Application A/c 90,000

(Being application money received on 9,000

equity shares @ ` 10 per share)

Equity Share Application A/c Dr. 90,000

To Equity Share Capital A/c 90,000

(Being application money transferred to

share capital A/c)

Equity Share Allotment Account Dr. 4,50,000

To Equity Share Capital Account 4,50,000

(Being allotment money due on 9,000

shares @ ` 50 per share)

In the place of above two entries one combined

can be made as:

Equity Share application A/c Dr. 90,000

Equity Share Allotment A/c Dr. 4,50,000

To Equity Share Capital A/c 5,40,000

(Being the transfer of application and allotment money

to share capital A/c on 9,000 shares @ ` 60 per share)

Bank Account Dr. 4,50,000

To Equity Share Allotment Account 4,50,000

(Being allotment money received on 9,000 shares

@ ` 50 per share)

Equity Share First Call Account Dr. 1,80,000

To Equity Share Capital Account 1,80,000

st

(Being 1 call money due on 9,000 shares @ ` 20 per share)

Bank Account Dr. 1,80,000

To Equity Share First Call Account 1,80,000

st

(Being 1 call money received on 9,000 shares @ ` 20

per share)

Equity Share Second & Final Call Account Dr. 1,80,000

To Equity Share Capital Account 1,80,000

(Being 2 nd and final call money due on 9,000 shares @ ` 20

per share)

Bank Account Dr. 1,80,000

To Equity Share Second & Final Call Account 1,80,000

(Being 2nd and final call money received on 9000 shares &

` 20 per share)

Balance Sheet of X Ltd. as on………..

Liabilities ` Assets `

Share Capital : Current Assets :

Cash at bank 9,00,000

Authorised Capital (10,000 equity shares of ` 100 each) 10,00,000

Issued, Subscribed, Called up and Paid up capital

(9,000 equity shares of ` 100 each) 9,00,000

9,00,000 9,00,000

LOVELY PROFESSIONAL UNIVERSITY 9