Page 254 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 254

Unit 10: Underwriting of Shares

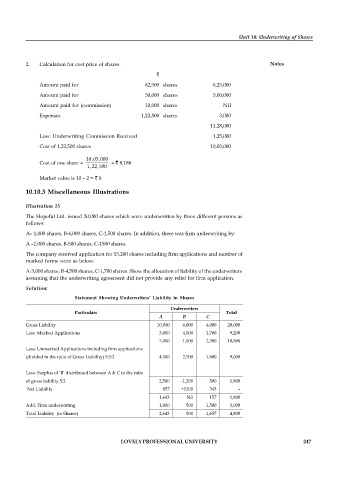

2. Calculation for cost price of shares. Notes

`

Amount paid for 62,500 shares 6,25,000

Amount paid for 50,000 shares 5,00,000

Amount paid for (commission) 10,000 shares Nil

Expenses 1,22,500 shares 3,000

11,28,000

Less: Underwriting Commission Received 1,25,000

Cost of 1,22,500 shares 10,03,000

10,03,000

Cost of one share = = ` 8.188

1,22,500

Market value is 10 – 2 = ` 8.

10.10.3 Miscellaneous Illustrations

Illustration 15

The Hopeful Ltd. issued 20,000 shares which were underwritten by three different persons as

follows:

A– 1,000 shares, B-6,000 shares, C-1,500 shares. In addition, there was firm underwriting by:

A –1,000 shares, B-500 shares, C-1500 shares.

The company received application for 15,200 shares including firm applications and number of

marked forms were as below:

A-3,000 shares, B-4,500 shares, C-1,700 shares. Show the allocation of liability of the underwriters

assuming that the underwriting agreement did not provide any relief for firm application.

Solution:

Statement Showing Underwriters’ Liability in Shares

Underwriters

Particulars Total

A B C

Gross Liability 10,000 6,000 4,000 20,000

Less: Marked Applications 3,000 4,500 1,700 9,200

7,000 1,500 2,300 10,800

Less: Unmarked Applications Including firm applications

(divided in the ratio of Gross Liability) 5:3:2 4,500 2,700 1,800 9,000

Less: Surplus of ‘B’ distributed between A & C in the ratio

of gross liability 5:2 2,500 –1,200 500 1,800

Net Liability 857 +1200 343 –

1,643 Nil 157 1,800

Add: Firm underwriting 1,000 500 1,500 3,000

Total Liability (in Shares) 2,643 500 1,657 4,800

LOVELY PROFESSIONAL UNIVERSITY 247