Page 118 - DCOM204_AUDITING_THEORY

P. 118

Auditing Theory

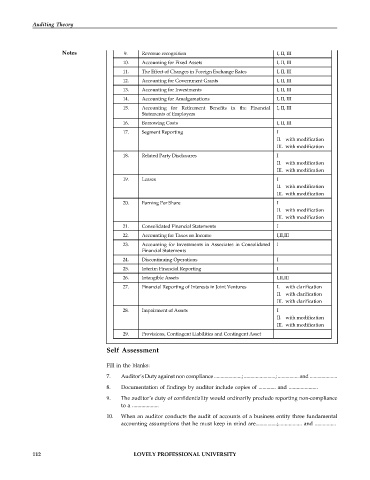

Notes 9. Revenue recognition I, II, III

10. Accounting for Fixed Assets I, II, III

11. The Effect of Changes in Foreign Exchange Rates I, II, III

12. Accounting for Government Grants I, II, III

13. Accounting for Investments I, II, III

14. Accounting for Amalgamations I, II, III

15. Accounting for Retirement Benefits in the Financial I, II, III

Statements of Employers

16. Borrowing Costs I, II, III

17. Segment Reporting I

II. with modification

III. with modification

18. Related Party Disclosures I

II. with modification

III. with modification

19. Leases I

II. with modification

III. with modification

20. Earning Per Share I

II. with modification

III. with modification

21. Consolidated Financial Statements I

22. Accounting for Taxes on Income I,II,III

23. Accounting for Investments in Associates in Consolidated I

Financial Statements

24. Discontinuing Operations I

25. Interim Financial Reporting I

26. Intangible Assets I,II,III

27. Financial Reporting of Interests in Joint Ventures I. with clarification

II. with clarification

III. with clarification

28. Impairment of Assets I

II. with modification

III. with modification

29. Provisions, Contingent Liabilities and Contingent Asset

Self Assessment

Fill in the blanks:

7. Auditor’s Duty against non compliance .....................; ........................; ................ and .....................

8. Documentation of findings by auditor include copies of ............. and ......................

9. The auditor’s duty of confidentiality would ordinarily preclude reporting non-compliance

to a ....................

10. When an auditor conducts the audit of accounts of a business entity three fundamental

accounting assumptions that he must keep in mind are................;.................. and ................

112 LOVELY PROFESSIONAL UNIVERSITY