Page 59 - DCOM204_AUDITING_THEORY

P. 59

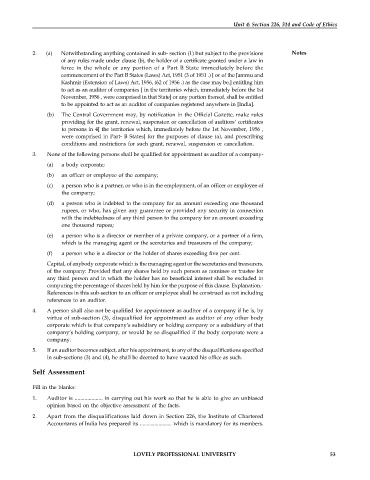

Unit 4: Section 226, 314 and Code of Ethics

2. (a) Notwithstanding anything contained in sub- section (1) but subject to the provisions Notes

of any rules made under clause (b), the holder of a certificate granted under a law in

force in the whole or any portion of a Part B State immediately before the

commencement of the Part B States (Laws) Act, 1951 (3 of 1951 .) [ or of the Jammu and

Kashmir (Extension of Laws) Act, 1956, (62 of 1956 .) as the case may be,] entitling him

to act as an auditor of companies [ in the territories which, immediately before the 1st

November, 1956 , were comprised in that State] or any portion thereof, shall be entitled

to be appointed to act as an auditor of companies registered anywhere in [India].

(b) The Central Government may, by notification in the Official Gazette, make rules

providing for the grant, renewal, suspension or cancellation of auditors’ certificates

to persons in 4[ the territories which, immediately before the 1st November, 1956 ,

were comprised in Part- B States] for the purposes of clause (a), and prescribing

conditions and restrictions for such grant, renewal, suspension or cancellation.

3. None of the following persons shall be qualified for appointment as auditor of a company-

(a) a body corporate;

(b) an officer or employee of the company;

(c) a person who is a partner, or who is in the employment, of an officer or employee of

the company;

(d) a person who is indebted to the company for an amount exceeding one thousand

rupees, or who, has given any guarantee or provided any security in connection

with the indebtedness of any third person to the company for an amount exceeding

one thousand rupees;

(e) a person who is a director or member of a private company, or a partner of a firm,

which is the managing agent or the secretaries and treasurers of the company;

(f) a person who is a director or the holder of shares exceeding five per cent.

Capital, of anybody corporate which is the managing agent or the secretaries and treasurers,

of the company: Provided that any shares held by such person as nominee or trustee for

any third person and in which the holder has no beneficial interest shall be excluded in

computing the percentage of shares held by him for the purpose of this clause. Explanation.-

References in this sub-section to an officer or employee shall be construed as not including

references to an auditor.

4. A person shall also not be qualified for appointment as auditor of a company if he is, by

virtue of sub-section (3), disqualified for appointment as auditor of any other body

corporate which is that company’s subsidiary or holding company or a subsidiary of that

company’s holding company, or would be so disqualified if the body corporate were a

company.

5. If an auditor becomes subject, after his appointment, to any of the disqualifications specified

in sub-sections (3) and (4), he shall be deemed to have vacated his office as such.

Self Assessment

Fill in the blanks:

1. Auditor is .................... in carrying out his work so that he is able to give an unbiased

opinion based on the objective assessment of the facts.

2. Apart from the disqualifications laid down in Section 226, the Institute of Chartered

Accountants of India has prepared its ........................ which is mandatory for its members.

LOVELY PROFESSIONAL UNIVERSITY 53