Page 169 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 169

Accounting for Companies – II

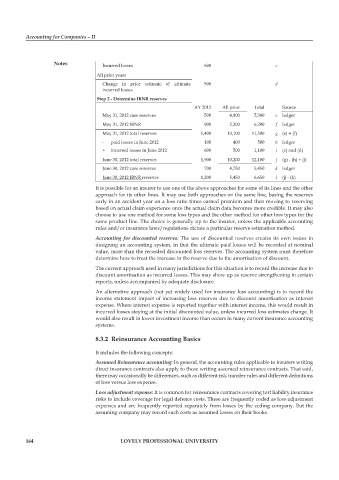

notes Incurred losses 600 c

All prior years

Change in prior estimate of ultimate 500 d

incurred losses

step 2 - Determine iBnr reserves

AY 2012 All prior Total Source

May 31, 2012 case reserves 500 4,800 5,300 e ledger

May 31, 2012 IBNR 900 5,300 6,200 f ledger

May 31, 2012 total reserves 1,400 10,100 11,500 g (e) + (f)

- paid losses in June 2012 100 400 500 h ledger

+ incurred losses in June 2012 600 500 1,100 i (c) and (d)

June 30, 2012 total reserves 1,900 10,200 12,100 j (g) - (h) + (i)

June 30, 2012 case reserves 700 4,750 5,450 k ledger

June 30, 2012 IBNR reserves 1,200 5,450 6,650 l (j) - (k)

It is possible for an insurer to use one of the above approaches for some of its lines and the other

approach for its other lines. It may use both approaches on the same line, basing the reserves

early in an accident year on a loss ratio times earned premium and then moving to reserving

based on actual claim experience once the actual claim data becomes more credible. It may also

choose to use one method for some loss types and the other method for other loss types for the

same product line. The choice is generally up to the insurer, unless the applicable accounting

rules and/or insurance laws/regulations dictate a particular reserve estimation method.

Accounting for discounted reserves: The use of discounted reserves creates its own issues in

designing an accounting system, in that the ultimate paid losses will be recorded at nominal

value, more than the recorded discounted loss reserves. The accounting system must therefore

determine how to treat the increase in the reserve due to the amortisation of discount.

The current approach used in many jurisdictions for this situation is to record the increase due to

discount amortisation as incurred losses. This may show up as reserve strengthening in certain

reports, unless accompanied by adequate disclosure.

An alternative approach (not yet widely used for insurance loss accounting) is to record the

income statement impact of increasing loss reserves due to discount amortisation as interest

expense. Where interest expense is reported together with interest income, this would result in

incurred losses staying at the initial discounted value, unless incurred loss estimates change. It

would also result in lower investment income than occurs in many current insurance accounting

systems.

8.3.2 reinsurance accounting Basics

It includes the following concepts:

Assumed Reinsurance accounting: In general, the accounting rules applicable to insurers writing

direct insurance contracts also apply to those writing assumed reinsurance contracts. That said,

there may occasionally be differences, such as different risk transfer rules and different definitions

of loss versus loss expense.

Loss adjustment expense: It is common for reinsurance contracts covering tort liability insurance

risks to include coverage for legal defence costs. These are frequently coded as loss adjustment

expenses and are frequently reported separately from losses by the ceding company. But the

assuming company may record such costs as assumed losses on their books.

164 lovely professional university