Page 64 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 64

Unit 4: Amalgamation: Accounting Treatment

notes

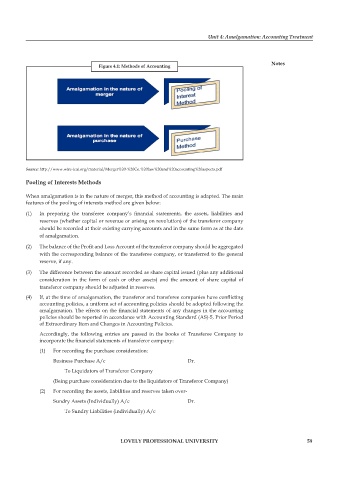

figure 4.1: methods of accounting

Source: http://www.wirc-icai.org/material/Merger%20-%20Co.%20law%20and%20accounting%20aspects.pdf

pooling of interests methods

When amalgamation is in the nature of merger, this method of accounting is adapted. The main

features of the pooling of interests method are given below:

(1) In preparing the transferee company’s financial statements, the assets, liabilities and

reserves (whether capital or revenue or arising on revolution) of the transferor company

should be recorded at their existing carrying accounts and in the same form as at the date

of amalgamation.

(2) The balance of the Profit and Loss Account of the transferor company should be aggregated

with the corresponding balance of the transferee company, or transferred to the general

reserve, if any.

(3) The difference between the amount recorded as share capital issued (plus any additional

consideration in the form of cash or other assets) and the amount of share capital of

transferor company should be adjusted in reserves.

(4) If, at the time of amalgamation, the transferor and transferee companies have conflicting

accounting policies, a uniform set of accounting policies should be adopted following the

amalgamation. The effects on the financial statements of any changes in the accounting

policies should be reported in accordance with Accounting Standard (AS)-5, Prior Period

of Extraordinary Item and Changes in Accounting Policies.

Accordingly, the following entries are passed in the books of Transferee Company to

incorporate the financial statements of transferor company:

(1) For recording the purchase consideration:

Business Purchase A/c Dr.

To Liquidators of Transferor Company

(Being purchase consideration due to the liquidators of Transferor Company)

(2) For recording the assets, liabilities and reserves taken over-

Sundry Assets (Individually) A/c Dr.

To Sundry Liabilities (individually) A/c

lovely professional university 59