Page 68 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 68

Unit 4: Amalgamation: Accounting Treatment

(8) For writing off the goodwill against Capital reserves- notes

Capital Reserve A/c Dr.

To Goodwill A/c

(Being goodwill written off against capital reserves)

self assessment

State whether the following statements are true or false:

6. Under the Net Payment Method, the purchase consideration is computed by adding all the

payments made by the transferee company to several interests in the transferor company.

7. Under the Net Assets Method, the purchase consideration by taking all assets including

fictitious assets.

8. Under the Net Assets Method, the net assets are calculated by adding the agreed value of

assets taken over minus agreed value of liabilities.

9. Workmen’s Accident Compensation Fund is an outside liability and must be closed by

transferring to realisation account.

10. Only in the case of amalgamation in the nature of merger, Goodwill or Capital Reserve

arises.

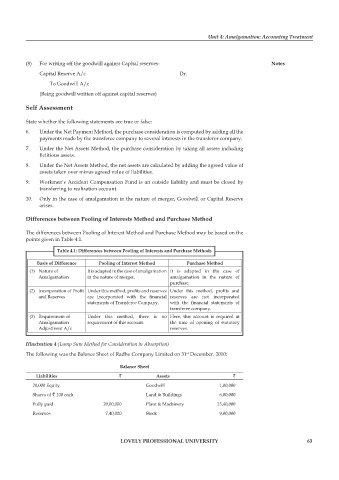

Differences between pooling of interests method and purchase method

The differences between Pooling of Interest Method and Purchase Method may be based on the

points given in Table 4.1.

table 4.1: Differences between pooling of interests and purchase methods

Basis of Difference pooling of interest method purchase method

(1) Nature of It is adapted in the case of amalgamation It is adapted in the case of

Amalgamation in the nature of merger. amalgamation in the nature of

purchase.

(2) Incorporation of Profit Under this method, profits and reserves Under this method, profits and

and Reserves are incorporated with the financial reserves are not incorporated

statements of Transferee Company. with the financial statements of

transferee company.

(3) Requirement of Under this method, there is no Here, this account is required at

Amalgamation requirement of this account. the time of opening of statutory

Adjustment A/c reserves.

Illustration 4 (Lump Sum Method for Consideration in Absorption)

The following was the Balance Sheet of Radhe Company Limited on 31 December, 2010:

st

Balance sheet

liabilities ` assets `

20,000 Equity Goodwill 1,00,000

Shares of ` 100 each Land & Buildings 6,00,000

Fully paid 20,00,000 Plant & Machinery 13,40,000

Reserves 7,40,000 Stock 9,00,000

lovely professional university 63