Page 73 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 73

Accounting for Companies – II

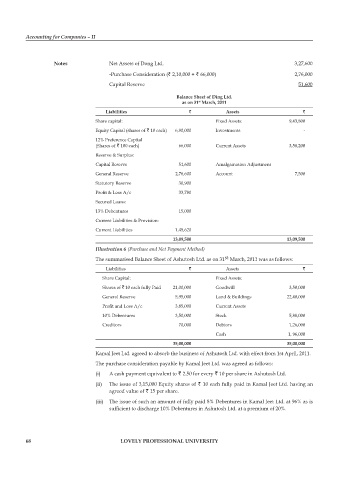

Notes Net Assets of Dong Ltd. 3,27,600

-Purchase Consideration (` 2,10,000 + ` 66,000) 2,76,000

Capital Reserve 51,600

Balance Sheet of Ding Ltd.

as on 31 March, 2011

st

Liabilities ` Assets `

Share capital: Fixed Assets: 9,43,800

Equity Capital (shares of ` 10 each) 6,90,000 Investments -

12% Preference Capital

(Shares of ` 100 each) 66,000 Current Assets 3,58,200

Reserve & Surplus:

Capital Reserve 51,600 Amalgamation Adjustment

General Reserve 2,76,600 Account 7,500

Statutory Reserve 30,900

Profit & Loss A/c 33,780

Secured Loans:

13% Debentures 15,000

Current Liabilities & Provision:

Current Liabilities 1,45,620

13,09,500 13,09,500

Illustration 6 (Purchase and Net Payment Method)

st

The summarised Balance Sheet of Ashutosh Ltd. as on 31 March, 2011 was as follows:

Liabilities ` Assets `

Share Capital: Fixed Assets:

Shares of ` 10 each fully Paid 21,00,000 Goodwill 3,50,000

General Reserve 5,95,000 Land & Buildings 22,40,000

Profit and Loss A/c 3,85,000 Current Assets

10% Debentures 3,50,000 Stock 5,88,000

Creditors 70,000 Debtors 1,26,000

Cash 1, 96,000

35,00,000 35,00,000

Kamal Jeet Ltd. agreed to absorb the business of Ashutosh Ltd. with effect from 1st April, 2011.

The purchase consideration payable by Kamal Jeet Ltd. was agreed as follows:

(i) A cash payment equivalent to ` 2.50 for every ` 10 per share in Ashutosh Ltd.

(ii) The issue of 3,15,000 Equity shares of ` 10 each fully paid in Kamal Jeet Ltd. having an

agreed value of ` 15 per share.

(iii) The issue of such an amount of fully paid 8% Debentures in Kamal Jeet Ltd. at 96% as is

sufficient to discharge 10% Debentures in Ashutosh Ltd. at a premium of 20%.

68 LOVELY PROFESSIONAL UNIVERSITY