Page 71 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 71

Accounting for Companies – II

notes Working Note:

1. Debentures are redeemed through Realisation A/c.

2. It is assumed that liquidation expenses are paid of directly by the Shyam Ltd.

3. It is further assumed that cash payment of ` 2,40,000 to the liquidation of Radhe Ltd. and

` 20,000 to the liquidation expenses of Radhe Ltd. are paid by Shyam Ltd. by taking a bank

loan of ` 2,60,000.

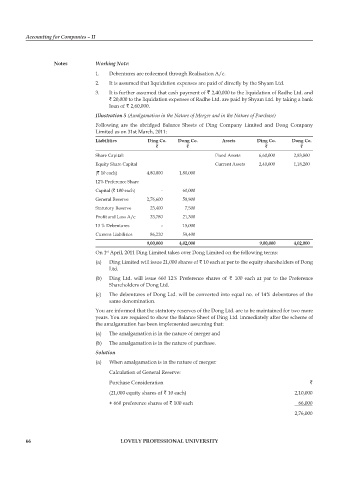

Illustration 5 (Amalgamation in the Nature of Merger and in the Nature of Purchase)

Following are the abridged Balance Sheets of Ding Company Limited and Dong Company

Limited as on 31st March, 2011:

liabilities Ding co. Dong co. assets Ding co. Dong co.

` ` ` `

Share Capital: Fixed Assets 6,60,000 2,83,800

Equity Share Capital Current Assets 2,40,000 1,18,200

(` 10 each) 4,80,000 1,80,000

12% Preference Share

Capital (` 100 each) - 60,000

General Reserve 2,76,600 58,800

Statutory Reserve 23,400 7,500

Profit and Loss A/c 33,780 21,300

13 % Debentures - 15,000

Current Liabilities 86,220 59,400

9,00,000 4,02,000 9,00,000 4,02,000

On 1 April, 2011 Ding Limited takes over Dong Limited on the following terms:

st

(a) Ding Limited will issue 21,000 shares of ` 10 each at per to the equity shareholders of Dong

Ltd.

(b) Ding Ltd. will issue 660 12% Preference shares of ` 100 each at par to the Preference

Shareholders of Dong Ltd.

(c) The debentures of Dong Ltd. will be converted into equal no. of 14% debentures of the

same denomination.

You are informed that the statutory reserves of the Dong Ltd. are to be maintained for two more

years. You are required to show the Balance Sheet of Ding Ltd. immediately after the scheme of

the amalgamation has been implemented assuming that:

(a) The amalgamation is in the nature of merger and

(b) The amalgamation is in the nature of purchase.

Solution

(a) When amalgamation is in the nature of merger:

Calculation of General Reserve:

Purchase Consideration `

(21,000 equity shares of ` 10 each) 2,10,000

+ 660 preference shares of ` 100 each 66,000

2,76,000

66 lovely professional university