Page 75 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 75

Accounting for Companies – II

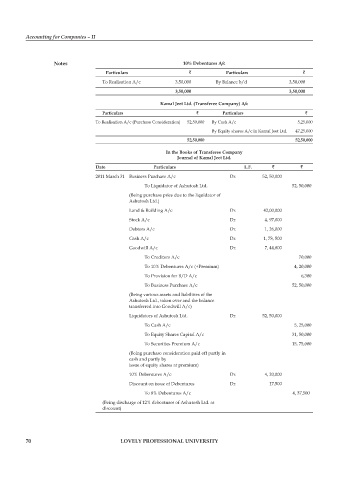

notes 10% Debentures a/c

particulars ` particulars `

To Realisation A/c 3,50,000 By Balance b/d 3,50,000

3,50,000 3,50,000

kamal Jeet ltd. (transferee company) a/c

particulars ` particulars `

To Realisation A/c (Purchase Consideration) 52,50,000 By Cash A/c 5,25,000

By Equity shares A/c in Kamal Jeet Ltd. 47,25,000

52,50,000 52,50,000

in the Books of transferee company

Journal of kamal Jeet ltd.

Date particulars l.f. ` `

2011 March 31 Business Purchase A/c Dr. 52, 50,000

To Liquidator of Ashutosh Ltd. 52, 50,000

(Being purchase price due to the liquidator of

Ashutosh Ltd.)

Land & Building A/c Dr. 42,00,000

Stock A/c Dr. 4, 97,000

Debtors A/c Dr. 1, 26,000

Cash A/c Dr. 1, 78, 500

Goodwill A/c Dr. 7, 44,800

To Creditors A/c 70,000

To 10% Debentures A/c (+Premium) 4, 20,000

To Provision for B/D A/c 6,300

To Business Purchase A/c 52, 50,000

(Being various assets and liabilities of the

Ashutosh Ltd., taken over and the balance

transferred into Goodwill A/c)

Liquidators of Ashutosh Ltd. Dr. 52, 50,000

To Cash A/c 5, 25,000

To Equity Shares Capital A/c 31, 50,000

To Securities Premium A/c 15, 75,000

(Being purchase consideration paid off partly in

cash and partly by

issue of equity shares at premium)

10% Debentures A/c Dr. 4, 20,000

Discount on issue of Debentures Dr. 17,500

To 8% Debentures A/c 4, 37,500

(Being discharge of 12% debentures of Ashutosh Ltd. at

discount)

70 lovely professional university