Page 70 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 70

Unit 4: Amalgamation: Accounting Treatment

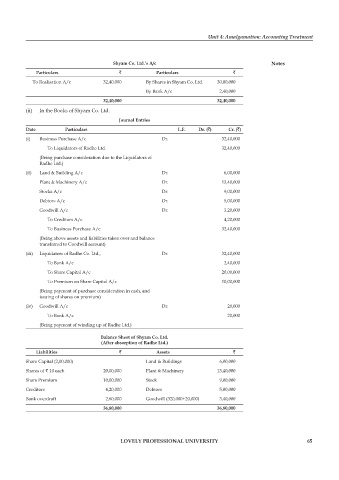

shyam co. ltd.’s a/c notes

particulars ` particulars `

To Realisation A/c 32,40,000 By Shares in Shyam Co. Ltd. 30,00,000

By Bank A/c 2,40,000

32,40,000 32,40,000

(ii) In the Books of Shyam Co. Ltd.

Journal entries

Date particulars l.f. Dr. (`) cr. (`)

(i) Business Purchase A/c Dr. 32,40,000

To Liquidators of Radhe Ltd. 32,40,000

(Being purchase consideration due to the Liquidators of

Radhe Ltd.)

(ii) Land & Building A/c Dr. 6,00,000

Plant & Machinery A/c Dr. 13,40,000

Stocks A/c Dr. 9,00,000

Debtors A/c Dr. 5,00,000

Goodwill A/c Dr. 3,20,000

To Creditors A/c 4,20,000

To Business Purchase A/c 32,40,000

(Being above assets and liabilities taken over and balance

transferred to Goodwill account)

(iii) Liquidators of Radhe Co. Ltd., Dr. 32,40,000

To Bank A/c 2,40,000

To Share Capital A/c 20,00,000

To Premium on Share Capital A/c 10,00,000

(Being payment of purchase consideration in cash, and

issuing of shares on premium)

(iv) Goodwill A/c Dr. 20,000

To Bank A/c 20,000

(Being payment of winding up of Radhe Ltd.)

Balance sheet of shyam co. ltd.

(after absorption of radhe ltd.)

liabilities ` assets `

Share Capital (2,00,000) Land & Buildings 6,00,000

Shares of ` 10 each 20,00,000 Plant & Machinery 13,40,000

Share Premium 10,00,000 Stock 9,00,000

Creditors 4,20,000 Debtors 5,00,000

Bank overdraft 2,60,000 Goodwill (320,000+20,000) 3,40,000

36,80,000 36,80,000

lovely professional university 65