Page 74 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 74

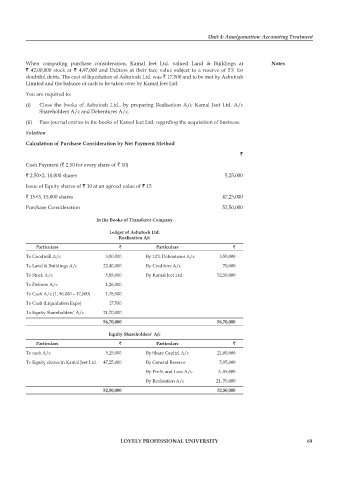

Unit 4: Amalgamation: Accounting Treatment

When computing purchase consideration, Kamal Jeet Ltd. valued Land & Buildings at notes

` 42,00,000 stock at ` 4,97,000 and Debtors at their face value subject to a reserve of 5% for

doubtful debts. The cost of liquidation of Ashutosh Ltd. was ` 17,500 and to be met by Ashutosh

Limited and the balance of cash to be taken over by Kamal Jeet Ltd.

You are required to:

(i) Close the books of Ashutosh Ltd., by preparing Realisation A/c Kamal Jeet Ltd. A/c

Shareholders A/c and Debentures A/c.

(ii) Pass journal entries in the books of Kamal Jeet Ltd. regarding the acquisition of business.

Solution

calculation of purchase consideration by net payment method

`

Cash Payment (` 2.50 for every share of ` 10)

` 2.50×2, 10,000 shares 5,25,000

Issue of Equity shares of ` 10 at an agreed value of ` 15

` 15×3, 15,000 shares 47,25,000

Purchase Consideration 52,50,000

in the Books of transferor company

ledger of ashutosh ltd.

realisation a/c

particulars ` particulars `

To Goodwill A/c 3,50,000 By 10% Debentures A/c 3,50,000

To Land & Buildings A/c 22,40,000 By Creditors A/c 70,000

To Stock A/c 5,88,000 By Kamal Jeet Ltd. 52,50,000

To Debtors A/c 1,26,000

To Cash A/c (1, 96,000 – 17,500) 1,78,500

To Cash (Liquidation Exps) 17,500

To Equity Shareholders’ A/c 21,70,000

56,70,000 56,70,000

equity shareholders’ a/c

particulars ` particulars `

To cash A/c 5,25,000 By Share Capital A/c 21,00,000

To Equity shares in Kamal Jeet Ltd. 47,25,000 By General Reserve 5,95,000

By Profit and Loss A/c 3, 85,000

By Realisation A/c 21, 70,000

52,50,000 52,50,000

lovely professional university 69