Page 76 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 76

Unit 4: Amalgamation: Accounting Treatment

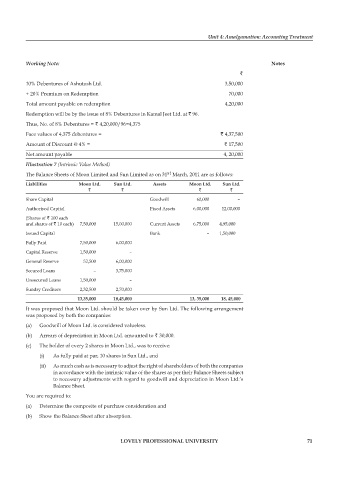

Working Note: notes

`

10% Debentures of Ashutosh Ltd. 3,50,000

+ 20% Premium on Redemption 70,000

Total amount payable on redemption 4,20,000

Redemption will be by the issue of 8% Debentures in Kamal Jeet Ltd. at ` 96.

Thus, No. of 8% Debentures = ` 4,20,000/96=4,375

Face values of 4,375 debentures = ` 4,37,500

Amount of Discount @ 4% = ` 17,500

Net amount payable 4, 20,000

Illustration 7 (Intrinsic Value Method)

st

The Balance Sheets of Moon Limited and Sun Limited as on 31 March, 2011 are as follows:

liabilities moon ltd. sun ltd. assets moon ltd. sun ltd.

` ` ` `

Share Capital Goodwill 60,000 –

Authorised Capital Fixed Assets 6,00,000 12,00,000

(Shares of ` 100 each

and shares of ` 10 each) 7,50,000 15,00,000 Current Assets 6,75,000 4,95,000

Issued Capital Bank – 1,50,000

Fully Paid 7,50,000 6,00,000

Capital Reserve 1,50,000 –

General Reserve 52,500 6,00,000

Secured Loans – 3,75,000

Unsecured Loans 1,50,000 –

Sundry Creditors 2,32,500 2,70,000

13,35,000 18,45,000 13, 35,000 18, 45,000

It was proposed that Moon Ltd. should be taken over by Sun Ltd. The following arrangement

was proposed by both the companies:

(a) Goodwill of Moon Ltd. is considered valueless.

(b) Arrears of depreciation in Moon Ltd. amounted to ` 30,000.

(c) The holder of every 2 shares in Moon Ltd., was to receive:

(i) As fully paid at par, 10 shares in Sun Ltd., and

(ii) As much cash as is necessary to adjust the right of shareholders of both the companies

in accordance with the intrinsic value of the shares as per their Balance Sheets subject

to necessary adjustments with regard to goodwill and depreciation in Moon Ltd.’s

Balance Sheet.

You are required to:

(a) Determine the composite of purchase consideration and

(b) Show the Balance Sheet after absorption.

lovely professional university 71