Page 77 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 77

Accounting for Companies – II

notes Solution

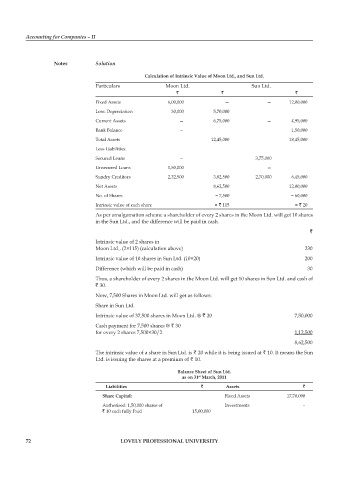

calculation of intrinsic value of moon ltd., and sun ltd.

Particulars Moon Ltd. Sun Ltd.

` ` `

Fixed Assets 6,00,000 — — 12,00,000

Less: Depreciation 30,000 5,70,000

Current Assets — 6,75,000 — 4,95,000

Bank Balance — 1,50,000

Total Assets 12,45,000 18,45,000

Less Liabilities:

Secured Loans — 3,75,000

Unsecured Loans 1,50,000 —

Sundry Creditors 2,32,500 3,82,500 2,70,000 6,45,000

Net Assets 8,62,500 12,00,000

No. of Shares = 7,500 = 60,000

Intrinsic value of each share = ` 115 = ` 20

As per amalgamation scheme a shareholder of every 2 shares in the Moon Ltd. will get 10 shares

in the Sun Ltd., and the difference will be paid in cash.

`

Intrinsic value of 2 shares in

Moon Ltd., (2×115) (calculation above) 230

Intrinsic value of 10 shares in Sun Ltd. (10×20) 200

Difference (which will be paid in cash) 30

Thus, a shareholder of every 2 shares in the Moon Ltd. will get 10 shares in Sun Ltd. and cash of

` 30.

Now, 7,500 Shares in Moon Ltd. will get as follows:

Share in Sun Ltd.

Intrinsic value of 37,500 shares in Moon Ltd. @ ` 20 7,50,000

Cash payment for 7,500 shares @ ` 30

for every 2 shares 7,500×30/2 1,12,500

8,62,500

The intrinsic value of a share in Sun Ltd. is ` 20 while it is being issued at ` 10. It means the Sun

Ltd. is issuing the shares at a premium of ` 10.

Balance sheet of sun ltd.

as on 31 march, 2011

st

liabilities ` assets `

share capital: Fixed Assets 17,70,000

Authorised: 1,50,000 shares of Investments –

` 10 each fully Paid 15,00,000

72 lovely professional university