Page 82 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 82

Unit 4: Amalgamation: Accounting Treatment

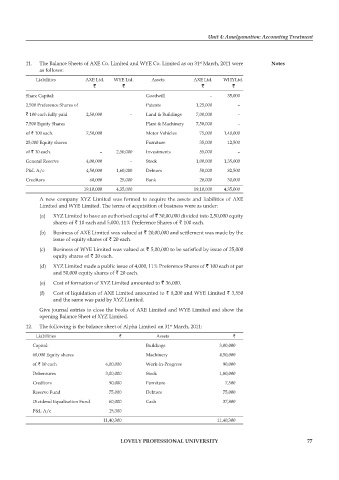

11. The Balance Sheets of AXE Co. Limited and WYE Co. Limited as on 31 March, 2011 were notes

st

as follows:

Liabilities AXE Ltd. WYE Ltd. Assets AXE Ltd. WHY Ltd.

` ` ` `

Share Capital: Goodwill – 35,000

2,500 Preference Shares of Patents 1,25,000 –

` 100 each fully paid 2,50,000 – Land & Buildings 7,00,000 –

7,500 Equity Shares Plant & Machinery 7,50,000 –

of ` 100 each. 7,50,000 Motor Vehicles 75,000 1,40,000

25,000 Equity shares Furniture 35,000 12,500

of ` 10 each. – 2,50,000 Investments 55,000 –

General Reserve 4,00,000 – Stock 1,00,000 1,35,000

P&L A/c 4,50,000 1,60,000 Debtors 50,000 82,500

Creditors 60,000 25,000 Bank 20,000 30,000

19,10,000 4,35,000 19,10,000 4,35,000

A new company XYZ Limited was formed to acquire the assets and liabilities of AXE

Limited and WYE Limited. The terms of acquisition of business were as under:

(a) XYZ Limited to have an authorised capital of ` 30,00,000 divided into 2,50,000 equity

shares of ` 10 each and 5,000, 11% Preference Shares of ` 100 each.

(b) Business of AXE Limited was valued at ` 20,00,000 and settlement was made by the

issue of equity shares of ` 20 each.

(c) Business of WYE Limited was valued at ` 5,00,000 to be satisfied by issue of 25,000

equity shares of ` 20 each.

(d) XYZ Limited made a public issue of 4,000, 11% Preference Shares of ` 100 each at par

and 50,000 equity shares of ` 20 each.

(e) Cost of formation of XYZ Limited amounted to ` 36,000.

(f) Cost of liquidation of AXE Limited amounted to ` 8,200 and WYE Limited ` 3,550

and the same was paid by XYZ Limited.

Give journal entries to close the books of AXE Limited and WYE Limited and show the

opening Balance Sheet of XYZ Limited.

12. The following is the balance sheet of Alpha Limited on 31 March, 2011:

st

Liabilities ` Assets `

Capital: Buildings 3,00,000

60,000 Equity shares Machinery 4,50,000

of ` 10 each 6,00,000 Work-in-Progress 90,000

Debentures 3,00,000 Stock 1,80,000

Creditors 90,000 Furniture 7,500

Reserve Fund 75,000 Debtors 75,000

Dividend Equalisation Fund 60,000 Cash 37,800

P&L A/c 15,300

11,40,300 11,40,300

lovely professional university 77