Page 87 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 87

Accounting for Companies – II

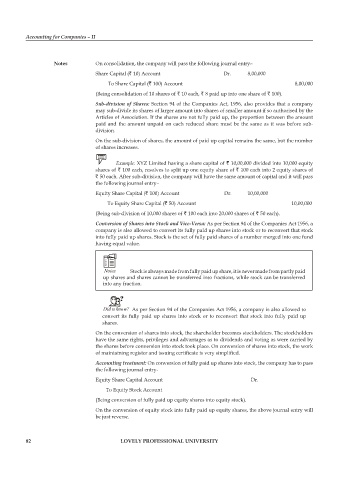

notes On consolidation, the company will pass the following journal entry–

Share Capital (` 10) Account Dr. 8,00,000

To Share Capital (` 100) Account 8,00,000

(Being consolidation of 10 shares of ` 10 each, ` 8 paid up into one share of ` 100).

Sub-division of Shares: Section 94 of the Companies Act, 1956, also provides that a company

may sub-divide its shares of larger amount into shares of smaller amount if so authorised by the

Articles of Association. If the shares are not fully paid up, the proportion between the amount

paid and the amount unpaid on each reduced share must be the same as it was before sub-

division.

On the sub-division of shares, the amount of paid up capital remains the same, but the number

of shares increases.

Example: XYZ Limited having a share capital of ` 10,00,000 divided into 10,000 equity

shares of ` 100 each, resolves to split up one equity share of ` 100 each into 2 equity shares of

` 50 each. After sub-division, the company will have the same amount of capital and it will pass

the following journal entry–

Equity Share Capital (` 100) Account Dr. 10,00,000

To Equity Share Capital (` 50) Account 10,00,000

(Being sub-division of 10,000 shares of ` 100 each into 20,000 shares of ` 50 each).

Conversion of Shares into Stock and Vice-Versa: As per Section 94 of the Companies Act 1956, a

company is also allowed to convert its fully paid up shares into stock or to reconvert that stock

into fully paid up shares. Stock is the set of fully paid shares of a number merged into one fund

having equal value.

Notes Stock is always made from fully paid up share, it is never made from partly paid

up shares and shares cannot be transferred into fractions, while stock can be transferred

into any fraction.

Did u know? As per Section 94 of the Companies Act 1956, a company is also allowed to

convert its fully paid up shares into stock or to reconvert that stock into fully paid up

shares.

On the conversion of shares into stock, the shareholder becomes stockholders. The stockholders

have the same rights, privileges and advantages as to dividends and voting as were carried by

the shares before conversion into stock took place. On conversion of shares into stock, the work

of maintaining register and issuing certificate is very simplified.

Accounting treatment: On conversion of fully paid up shares into stock, the company has to pass

the following journal entry-

Equity Share Capital Account Dr.

To Equity Stock Account

(Being conversion of fully paid up equity shares into equity stock).

On the conversion of equity stock into fully paid up equity shares, the above journal entry will

be just reverse.

82 lovely professional university