Page 78 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 78

Unit 4: Amalgamation: Accounting Treatment

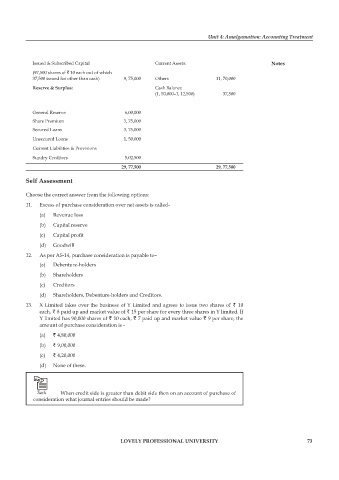

Issued & Subscribed Capital Current Assets: notes

(97,500 shares of ` 10 each out of which

37,500 issued for other than cash) 9, 75,000 Others 11, 70,000

reserve & surplus: Cash Balance

(1, 50,000–1, 12,500) 37,500

General Reserve 6,00,000

Share Premium 3, 75,000

Secured Loans 3, 75,000

Unsecured Loans 1, 50,000

Current Liabilities & Provisions

Sundry Creditors 5,02,500

29, 77,500 29, 77,500

self assessment

Choose the correct answer from the following options:

11. Excess of purchase consideration over net assets is called-

(a) Revenue loss

(b) Capital reserve

(c) Capital profit

(d) Goodwill

12. As per AS-14, purchase consideration is payable to–

(a) Debenture-holders

(b) Shareholders

(c) Creditors

(d) Shareholders, Debenture-holders and Creditors.

13. X Limited takes over the business of Y Limited and agrees to issue two shares of ` 10

each, ` 8 paid up and market value of ` 15 per share for every three shares in Y limited. If

Y limited has 90,000 shares of ` 10 each, ` 7 paid up and market value ` 9 per share, the

amount of purchase consideration is -

(a) ` 4,80,000

(b) ` 9,00,000

(c) ` 4,20,000

(d) None of these.

Task When credit side is greater than debit side then on an account of purchase of

consideration what journal entries should be made?

lovely professional university 73