Page 72 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 72

Unit 4: Amalgamation: Accounting Treatment

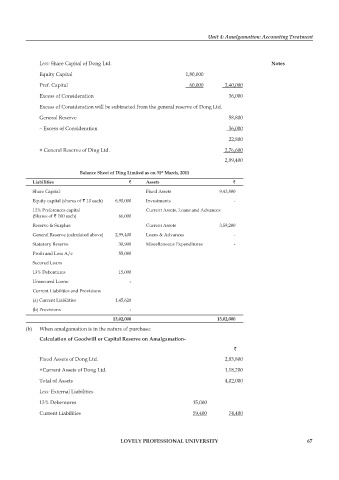

Less: Share Capital of Dong Ltd. notes

Equity Capital 1,80,000

Pref. Capital 60,000 2,40,000

Excess of Consideration 36,000

Excess of Consideration will be subtracted from the general reserve of Dong Ltd.

General Reserve 58,800

– Excess of Consideration 36,000

22,800

+ General Reserve of Ding Ltd. 2,76,600

2,99,400

Balance sheet of Ding limited as on 31 march, 2011

st

liabilities ` assets `

Share Capital: Fixed Assets 9,43,800

Equity capital (shares of ` 10 each) 6,90,000 Investments -

12% Preferences capital Current Assets, Loans and Advances

(Shares of ` 100 each) 66,000

Reserve & Surplus: Current Assets 3,58,200

General Reserve (calculated above) 2,99,400 Loans & Advances -

Statutory Reserve 30,900 Miscellaneous Expenditures -

Profit and Loss A/c 55,080

Secured Loans

13% Debentures 15,000

Unsecured Loans: -

Current Liabilities and Provisions

(a) Current Liabilities 1,45,620

(b) Provisions -

13,02,000 13,02,000

(b) When amalgamation is in the nature of purchase:

calculation of goodwill or capital reserve on amalgamation-

`

Fixed Assets of Dong Ltd. 2,83,800

+Current Assets of Dong Ltd. 1,18,200

Total of Assets 4,02,000

Less: External Liabilities

13% Debentures 15,000

Current Liabilities 59,400 74,400

lovely professional university 67