Page 179 - DCOM206_COST_ACCOUNTING_II

P. 179

Cost Accounting – II

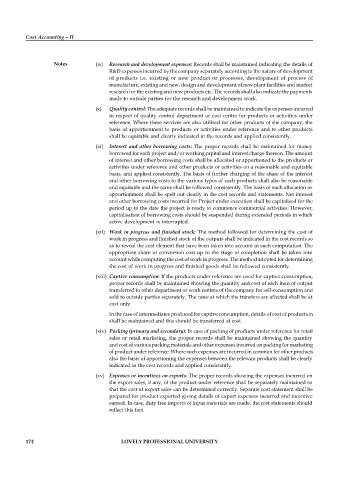

Notes (ix) Research and development expenses: Records shall be maintained indicating the details of

R&D expenses incurred by the company separately according to the nature of development

of products i.e. existing or new product or processes, development of process of

manufacture, existing and new, design and development of new plant facilities and market

research for the existing and new products etc. The records shall also indicate the payments

made to outside parties for the research and development work.

(x) Quality control: The adequate records shall be maintained to indicate the expenses incurred

in respect of quality control department or cost centre for products or activities under

reference. Where these services are also utilised for other products of the company, the

basis of apportionment to products or activities under reference and to other products

shall be equitable and clearly indicated in the records and applied consistently.

(xi) Interest and other borrowing costs: The proper records shall be maintained for money

borrowed for each project and/or working capital and interest charge thereon. The amount

of interest and other borrowing costs shall be allocated or apportioned to the products or

activities under reference and other products or activities on a reasonable and equitable

basis, and applied consistently. The basis of further charging of the share of the interest

and other borrowing costs to the various types of such products shall also be reasonable

and equitable and the same shall be followed consistently. The basis of such allocation or

apportionment shall be spelt out clearly in the cost records and statements. Net interest

and other borrowing costs incurred for Project under execution shall be capitalised for the

period up to the date the project is ready to commence commercial activities. However,

capitalisation of borrowing costs should be suspended during extended periods in which

active development is interrupted.

(xii) Work in progress and finished stock: The method followed for determining the cost of

work in progress and finished stock of the outputs shall be indicated in the cost records so

as to reveal the cost element that have been taken into account in such computation. The

appropriate share of conversion cost up to the stage of completion shall be taken into

account while computing the cost of work in progress. The method adopted for determining

the cost of work in progress and finished goods shall be followed consistently.

(xiii) Captive consumption: If the products under reference are used for captive consumption,

proper records shall be maintained showing the quantity and cost of each item of output

transferred to other department or work centres of the company for self-consumption and

sold to outside parties separately. The rates at which the transfers are affected shall be at

cost only.

In the case of intermediates produced for captive consumption, details of cost of production

shall be maintained and this should be transferred at cost.

(xiv) Packing (primary and secondary): In case of packing of products under reference for retail

sales or retail marketing, the proper records shall be maintained showing the quantity

and cost of various packing materials and other expenses incurred on packing for marketing

of product under reference. Where such expenses are incurred in common for other products

also the basis of apportioning the expenses between the relevant products shall be clearly

indicated in the cost records and applied consistently.

(xv) Expenses or incentives on exports: The proper records showing the expenses incurred on

the export sales, if any, of the product under reference shall be separately maintained so

that the cost of export sales can be determined correctly. Separate cost statement shall be

prepared for product exported giving details of export expenses incurred and incentive

earned. In case, duty free imports of input materials are made, the cost statements should

reflect this fact.

174 LOVELY PROFESSIONAL UNIVERSITY