Page 98 - DCOM206_COST_ACCOUNTING_II

P. 98

Unit 5: Differential Costing

At 8000 level of output, the total sales revenue is ` 7,60,000 and the total cost is ` 5,92,000 leaving Notes

a profit of ` 1,68,000. The fact that this level of output leaves a profit means that fixed costs have

been recovered already. Hence we have to take only the incremental cost for further level of

output. For an additional sales of 2.000 units the incremental cost is ` 7,10,000 - ` 5,92,000 =

` 1,18,000. The cost per unit therefore is 1,18,000/2000 = ` 59 for which the price quoted is ` 70

per unit. Hence the offer is to be accepted.

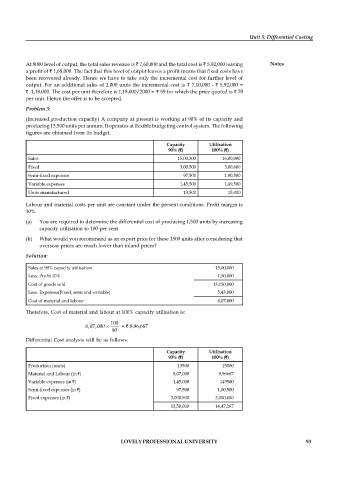

Problem 3:

(Increased production capacity) A company at present is working at 90% of its capacity and

producing 13,500 units per annum. It operates at flexible budgeting control system. The following

figures are obtained from its budget.

Capacity Utilisation

90% (`) 100% (`)

Sales 15,00,300 16,00,000

Fixed 3,00.500 3,00,600

Semi-fixed expenses 97,500 1.00,500

Variable expenses 1,45,500 1,49,500

Units manufactured 13,500 15,000

Labour and material costs per unit are constant under the present conditions. Profit margin is

10%.

(a) You are required to determine the differential cost of producing 1,500 units by increasing

capacity utilisation to 100 per cent.

(b) What would you recommend as an export price for these 1500 units after considering that

overseas prices are much lower than inland prices?

Solution:

Sales at 90% capacity utilisation 15,00,000

Less: Profit 10% 1,50,000

Cost of goods sold 13,150,000

Less: Expenses(Fixed, semi and variable) 5,43,000

Cost of material and labour 8,07,000

Therefore, Cost of material and labour at 100% capacity utilisation is:

100

8,07,000 = ` 8,96,667

90

Differential Cost analysis will be as follows:

Capacity Utilisation

90% (`) 100% (`)

Production (units) 13500 15000

Material and Labour (in `) 8,07,000 8,96667

Variable expenses (in `) 1,45,000 149500

Semi-fixed expenses (in `) 97,500 1,00,500

Fixed expenses (in `) 3,000.500 3,000,600

13,50,000 14,47,267

LOVELY PROFESSIONAL UNIVERSITY 93