Page 107 - DCOM208_BANKING_THEORY_AND_PRACTICE

P. 107

Banking Theory and Practice

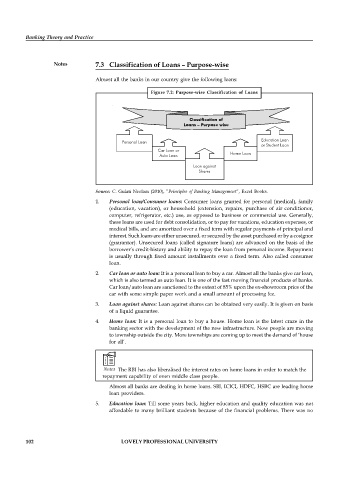

Notes 7.3 Classification of Loans – Purpose-wise

Almost all the banks in our country give the following loans:

Figure 7.2: Purpose-wise Classification of Loans

Classification of

Loans – Purpose wise

Education Loan

Personal Loan

or Student Loan

Car Loan or

Auto Loan Home Loan

Loan against

Shares

Source: C. Gulati Neelam (2010), ”Principles of Banking Management”, Excel Books.

1. Personal loan/Consumer loans: Consumer loans granted for personal (medical), family

(education, vacation), or household (extension, repairs, purchase of air conditioner,

computer, refrigerator, etc.) use, as opposed to business or commercial use. Generally,

these loans are used for debt consolidation, or to pay for vacations, education expenses, or

medical bills, and are amortized over a fixed term with regular payments of principal and

interest. Such loans are either unsecured, or secured by the asset purchased or by a cosignor

(guarantor). Unsecured loans (called signature loans) are advanced on the basis of the

borrower’s credit-history and ability to repay the loan from personal income. Repayment

is usually through fixed amount installments over a fixed term. Also called consumer

loan.

2. Car loan or auto loan: It is a personal loan to buy a car. Almost all the banks give car loan,

which is also termed as auto loan. It is one of the fast moving financial products of banks.

Car loan/auto loan are sanctioned to the extent of 85% upon the ex-showroom price of the

car with some simple paper work and a small amount of processing fee.

3. Loan against shares: Loan against shares can be obtained very easily. It is given on basis

of a liquid guarantee.

4. Home loan: It is a personal loan to buy a house. Home loan is the latest craze in the

banking sector with the development of the new infrastructure. Now people are moving

to township outside the city. More townships are coming up to meet the demand of ‘house

for all’.

Notes The RBI has also liberalised the interest rates on home loans in order to match the

repayment capability of even middle class people.

Almost all banks are dealing in home loans. SBI, ICICI, HDFC, HSBC are leading home

loan providers.

5. Education loan: Till some years back, higher education and quality education was not

affordable to many brilliant students because of the financial problems. There was no

102 LOVELY PROFESSIONAL UNIVERSITY