Page 114 - DCOM301_INCOME_TAX_LAWS_I

P. 114

Unit 4: Exemptions and Deductions - I

(m) Contribution to notified annuity Plan of LIC (e.g. Jeevan Dhara) or Units of UTI/ Notes

notified Mutual Fund. If in respect of such contribution, deduction u/s 80CCC has

been availed of rebate u/s 88 would not be allowable.

(n) Subscription to units of a Mutual Fund notified u/s 10(23D).

(o) Subscription to deposit scheme of a public sector, company engaged in providing

housing finance.

(p) Subscription to equity shares or debentures forming part of any approved eligible

issue of capital made by a public company or public financial institutions.

(q) Tuition fees paid at the time of admission or otherwise to any school, college,

university or other educational institution situated within India for the purpose of

full time education of any two children. Available in respect of any two children

2. Section 80CCC - Deduction in respect of Premium Paid for Annuity Plan of LIC or Other

Insurer: Payment of premium for annuity plan of LIC or any other insurer Deduction is

available upto a maximum of ` 100,000/-. (This limit has been increased from ` 10,000/- to

` 1,00,000/- w.e.f. 01.04.2007). The premium must be deposited to keep in force a contract

for an annuity plan of the LIC or any other insurer for receiving pension from the fund.

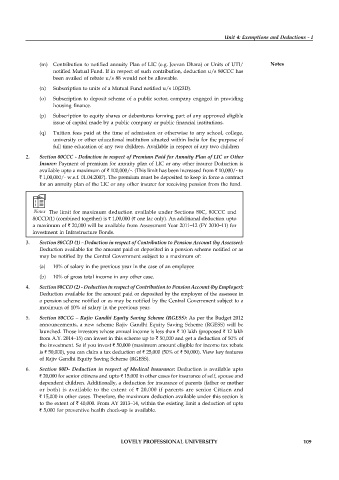

Notes The limit for maximum deduction available under Sections 80C, 80CCC and

80CCD(1) (combined together) is ` 1,00,000 (` one lac only). An additional deduction upto

a maximum of ` 20,000 will be available from Assessment Year 2011–12 (FY 2010–11) for

investment in Infrastructure Bonds.

3. Section 80CCD (1) - Deduction in respect of Contribution to Pension Account (by Assessee}:

Deduction available for the amount paid or deposited in a pension scheme notified or as

may be notified by the Central Government subject to a maximum of:

(a) 10% of salary in the previous year in the case of an employee

(b) 10% of gross total income in any other case.

4. Section 80CCD (2) - Deduction in respect of Contribution to Pension Account (by Employer}:

Deduction available for the amount paid or deposited by the employer of the assessee in

a pension scheme notified or as may be notified by the Central Government subject to a

maximum of 10% of salary in the previous year.

5. Section 80CCG – Rajiv Gandhi Equity Saving Scheme (RGESS): As per the Budget 2012

announcements, a new scheme Rajiv Gandhi Equity Saving Scheme (RGESS) will be

launched. Those investors whose annual income is less than ` 10 lakh (proposed ` 12 lakh

from A.Y. 2014–15) can invest in this scheme up to ` 50,000 and get a deduction of 50% of

the investment. So if you invest ` 50,000 (maximum amount eligible for income tax rebate

is ` 50,000), you can claim a tax deduction of ` 25,000 (50% of ` 50,000). View key features

of Rajiv Gandhi Equity Saving Scheme (RGESS).

6. Section 80D- Deduction in respect of Medical Insurance: Deduction is available upto

` 20,000 for senior citizens and upto ` 15,000 in other cases for insurance of self, spouse and

dependent children. Additionally, a deduction for insurance of parents (father or mother

or both) is available to the extent of ` 20,000 if parents are senior Citizen and

` 15,000 in other cases. Therefore, the maximum deduction available under this section is

to the extent of ` 40,000. From AY 2013–14, within the existing limit a deduction of upto

` 5,000 for preventive health check-up is available.

LOVELY PROFESSIONAL UNIVERSITY 109