Page 115 - DCOM301_INCOME_TAX_LAWS_I

P. 115

Income Tax Laws – I

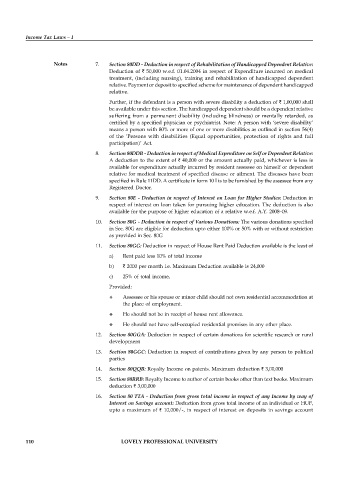

Notes 7. Section 80DD - Deduction in respect of Rehabilitation of Handicapped Dependent Relative:

Deduction of ` 50,000 w.e.f. 01.04.2004 in respect of Expenditure incurred on medical

treatment, (including nursing), training and rehabilitation of handicapped dependent

relative. Payment or deposit to specified scheme for maintenance of dependent handicapped

relative.

Further, if the defendant is a person with severe disability a deduction of ` 1,00,000 shall

be available under this section. The handicapped dependent should be a dependent relative

suffering from a permanent disability (including blindness) or mentally retarded, as

certified by a specified physician or psychiatrist. Note: A person with ‘severe disability’

means a person with 80% or more of one or more disabilities as outlined in section 56(4)

of the ‘Persons with disabilities (Equal opportunities, protection of rights and full

participation)’ Act.

8. Section 80DDB - Deduction in respect of Medical Expenditure on Self or Dependent Relative:

A deduction to the extent of ` 40,000 or the amount actually paid, whichever is less is

available for expenditure actually incurred by resident assessee on himself or dependent

relative for medical treatment of specified disease or ailment. The diseases have been

specified in Rule 11DD. A certificate in form 10 I is to be furnished by the assessee from any

Registered Doctor.

9. Section 80E - Deduction in respect of Interest on Loan for Higher Studies: Deduction in

respect of interest on loan taken for pursuing higher education. The deduction is also

available for the purpose of higher education of a relative w.e.f. A.Y. 2008–09.

10. Section 80G - Deduction in respect of Various Donations: The various donations specified

in Sec. 80G are eligible for deduction upto either 100% or 50% with or without restriction

as provided in Sec. 80G

11. Section 80GG: Deduction in respect of House Rent Paid Deduction available is the least of

a) Rent paid less 10% of total income

b) ` 2000 per month i.e. Maximum Deduction available is 24,000

c) 25% of total income,

Provided:

Assessee or his spouse or minor child should not own residential accommodation at

the place of employment.

He should not be in receipt of house rent allowance.

He should not have self-occupied residential premises in any other place.

12. Section 80GGA: Deduction in respect of certain donations for scientific research or rural

development

13. Section 80GGC: Deduction in respect of contributions given by any person to political

parties

14. Section 80QQB: Royalty Income on patents. Maximum deduction ` 3,00,000

15. Section 80RRB: Royalty Income to author of certain books other than text books. Maximum

deduction ` 3,00,000

16. Section 80 TTA - Deduction from gross total income in respect of any Income by way of

Interest on Savings account: Deduction from gross total income of an individual or HUF,

upto a maximum of ` 10,000/-, in respect of interest on deposits in savings account

110 LOVELY PROFESSIONAL UNIVERSITY