Page 185 - DCOM301_INCOME_TAX_LAWS_I

P. 185

Income Tax Laws – I

Notes 2. Allowance to High Court and Supreme Court Judges of whatever nature are exempt from

tax.

3. Allowances from UNO organisation to its employees are fully exempt from tax

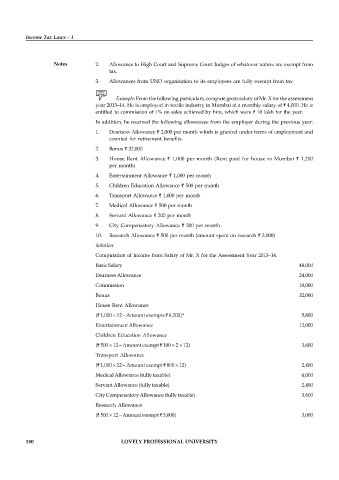

Example: From the following particulars, compute gross salary of Mr. X for the assessment

year 2013–14. He is employed in textile industry in Mumbai at a monthly salary of ` 4,000. He is

entitled to commission of 1% on sales achieved by him, which were ` 10 lakh for the year.

In addition, he received the following allowances from the employer during the previous year:

1. Dearness Allowance ` 2,000 per month which is granted under terms of employment and

counted for retirement benefits.

2. Bonus ` 32,000

3. House Rent Allowance ` 1,000 per month (Rent paid for house in Mumbai ` 1,200

per month)

4. Entertainment Allowance ` 1,000 per month

5. Children Education Allowance ` 500 per month

6. Transport Allowance ` 1,000 per month

7. Medical Allowance ` 500 per month

8. Servant Allowance ` 200 per month

9. City Compensatory Allowance ` 300 per month

10. Research Allowance ` 500 per month (amount spent on research ` 3,000)

Solution:

Computation of Income from Salary of Mr. X for the Assessment Year 2013–14.

Basic Salary 48,000

Dearness Allowance 24,000

Commission 10,000

Bonus 32,000

House Rent Allowance

(` 1,000 × 12 – Amount exempts ` 6,200)* 5,800

Entertainment Allowance 12,000

Children Education Allowance

(` 500 × 12 – Amount exempt ` 100 × 2 × 12) 3,600

Transport Allowance

(` 1,000 × 12 – Amount exempt ` 800 × 12) 2,400

Medical Allowance (fully taxable) 6,000

Servant Allowance (fully taxable) 2,400

City Compensatory Allowance (fully taxable) 3,600

Research Allowance

(` 500 × 12 – Amount exempt ` 3,000) 3,000

180 LOVELY PROFESSIONAL UNIVERSITY