Page 190 - DCOM301_INCOME_TAX_LAWS_I

P. 190

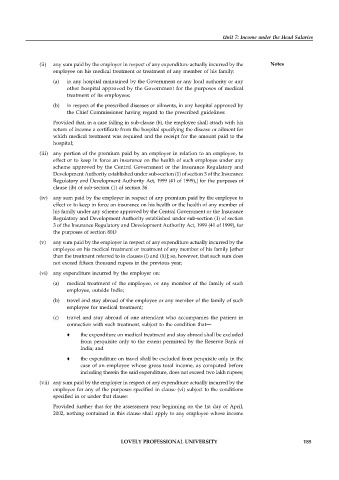

Unit 7: Income under the Head Salaries

(ii) any sum paid by the employer in respect of any expenditure actually incurred by the Notes

employee on his medical treatment or treatment of any member of his family:

(a) in any hospital maintained by the Government or any local authority or any

other hospital approved by the Government for the purposes of medical

treatment of its employees;

(b) in respect of the prescribed diseases or ailments, in any hospital approved by

the Chief Commissioner having regard to the prescribed guidelines:

Provided that, in a case falling in sub-clause (b), the employee shall attach with his

return of income a certificate from the hospital specifying the disease or ailment for

which medical treatment was required and the receipt for the amount paid to the

hospital;

(iii) any portion of the premium paid by an employer in relation to an employee, to

effect or to keep in force an insurance on the health of such employee under any

scheme approved by the Central Government or the Insurance Regulatory and

Development Authority established under sub-section (1) of section 3 of the Insurance

Regulatory and Development Authority Act, 1999 (41 of 1999),] for the purposes of

clause (ib) of sub-section (1) of section 36

(iv) any sum paid by the employer in respect of any premium paid by the employee to

effect or to keep in force an insurance on his health or the health of any member of

his family under any scheme approved by the Central Government or the Insurance

Regulatory and Development Authority established under sub-section (1) of section

3 of the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999), for

the purposes of section 80D

(v) any sum paid by the employer in respect of any expenditure actually incurred by the

employee on his medical treatment or treatment of any member of his family [other

than the treatment referred to in clauses (i) and (ii)]; so, however, that such sum does

not exceed fifteen thousand rupees in the previous year;

(vi) any expenditure incurred by the employer on:

(a) medical treatment of the employee, or any member of the family of such

employee, outside India;

(b) travel and stay abroad of the employee or any member of the family of such

employee for medical treatment;

(c) travel and stay abroad of one attendant who accompanies the patient in

connection with such treatment, subject to the condition that—

the expenditure on medical treatment and stay abroad shall be excluded

from perquisite only to the extent permitted by the Reserve Bank of

India; and

the expenditure on travel shall be excluded from perquisite only in the

case of an employee whose gross total income, as computed before

including therein the said expenditure, does not exceed two lakh rupees;

(vii) any sum paid by the employer in respect of any expenditure actually incurred by the

employee for any of the purposes specified in clause (vi) subject to the conditions

specified in or under that clause:

Provided further that for the assessment year beginning on the 1st day of April,

2002, nothing contained in this clause shall apply to any employee whose income

LOVELY PROFESSIONAL UNIVERSITY 185