Page 198 - DCOM301_INCOME_TAX_LAWS_I

P. 198

Unit 7: Income under the Head Salaries

Notes

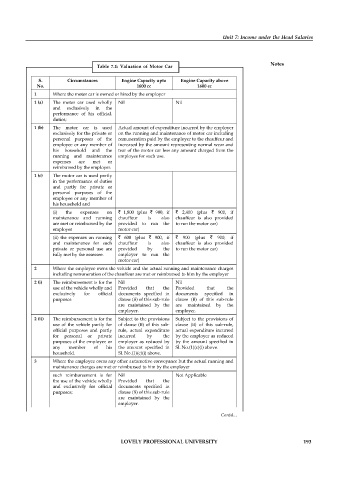

Table 7.1: Valuation of Motor Car

S. Circumstances Engine Capacity upto Engine Capacity above

No. 1600 cc 1600 cc

1 Where the motor car is owned or hired by the employer

1 (a) The motor car used wholly Nil Nil

and exclusively in the

performance of his official.

duties;

1 (b) The motor car is used Actual amount of expenditure incurred by the employer

exclusively for the private or on the running and maintenance of motor car including

personal purposes of the remuneration paid by the employer to the chauffeur and

employee or any member of increased by the amount representing normal wear and

his household and the tear of the motor car less any amount charged from the

running and maintenance employee for such use.

expenses are met or

reimbursed by the employer.

1 (c) The motor car is used partly

in the performance of duties

and partly for private or

personal purposes of the

employee or any member of

his household and

(i) the expenses on ` 1,800 (plus ` 900, if ` 2,400 (plus ` 900, if

maintenance and running chauffeur is also chauffeur is also provided

are met or reimbursed by the provided to run the to run the motor car)

employer motor car)

(ii) the expenses on running ` 600 (plus ` 900, if ` 900 (plus ` 900, if

and maintenance for such chauffeur is also chauffeur is also provided

private or personal use are provided by the to run the motor car)

fully met by the assessee. employer to run the

motor car)

2 Where the employee owns the vehicle and the actual running and maintenance charges

including remuneration of the chauffeur are met or reimbursed to him by the employer

2 (i) The reimbursement is for the Nil Nil

use of the vehicle wholly and Provided that the Provided that the

exclusively for official documents specified in documents specified in

purposes clause (B) of this sub-rule clause (B) of this sub-rule

are maintained by the are maintained by the

employer. employer.

2 (ii) The reimbursement is for the Subject to the provisions Subject to the provisions of

use of the vehicle partly for of clause (B) of this sub- clause (B) of this sub-rule,

official purposes and partly rule, actual expenditure actual expenditure incurred

for personal or private incurred by the by the employer as reduced

purposes of the employee or employer as reduced by by the amount specified in

any member of his the amount specified in Sl. No.(1)(c)(i) above.

household. Sl. No.(1)(c)(i) above.

3 Where the employee owns any other automotive conveyance but the actual running and

maintenance charges are met or reimbursed to him by the employer

such reimbursement is for Nil Not Applicable

the use of the vehicle wholly Provided that the

and exclusively for official documents specified in

purposes; clause (B) of this sub-rule

are maintained by the

employer.

Contd...

LOVELY PROFESSIONAL UNIVERSITY 193