Page 202 - DCOM301_INCOME_TAX_LAWS_I

P. 202

Unit 7: Income under the Head Salaries

Notes

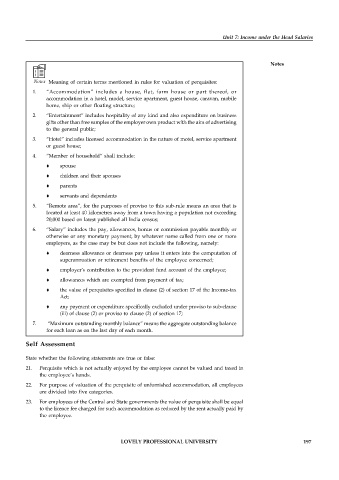

Notes Meaning of certain terms mentioned in rules for valuation of perquisites:

1. “Accommodation” includes a house, flat, farm house or part thereof, or

accommodation in a hotel, model, service apartment, guest house, caravan, mobile

home, ship or other floating structure;

2. “Entertainment” includes hospitality of any kind and also expenditure on business

gifts other than free samples of the employer own product with the aim of advertising

to the general public;

3. “Hotel” includes licensed accommodation in the nature of motel, service apartment

or guest house;

4. “Member of household” shall include:

spouse

children and their spouses

parents

servants and dependents

5. “Remote area”, for the purposes of proviso to this sub-rule means an area that is

located at least 40 kilometres away from a town having a population not exceeding

20,000 based on latest published all India census;

6. “Salary” includes the pay, allowances, bonus or commission payable monthly or

otherwise or any monetary payment, by whatever name called from one or more

employers, as the case may be but does not include the following, namely:

dearness allowance or dearness pay unless it enters into the computation of

superannuation or retirement benefits of the employee concerned;

employer’s contribution to the provident fund account of the employee;

allowances which are exempted from payment of tax;

the value of perquisites specified in clause (2) of section 17 of the Income-tax

Act;

any payment or expenditure specifically excluded under proviso to sub-clause

(iii) of clause (2) or proviso to clause (2) of section 17;

7. “Maximum outstanding monthly balance” means the aggregate outstanding balance

for each loan as on the last day of each month.

Self Assessment

State whether the following statements are true or false:

21. Perquisite which is not actually enjoyed by the employee cannot be valued and taxed in

the employee’s hands.

22. For purpose of valuation of the perquisite of unfurnished accommodation, all employees

are divided into five categories.

23. For employees of the Central and State governments the value of perquisite shall be equal

to the licence fee charged for such accommodation as reduced by the rent actually paid by

the employee.

LOVELY PROFESSIONAL UNIVERSITY 197