Page 241 - DCOM301_INCOME_TAX_LAWS_I

P. 241

Income Tax Laws – I

Notes Depreciation 10,000

Interest on borrowed capital (loan taken on 1.1.2000) 2, 00,000

House was purchased on 1.5.2001.

Solution:

Income from House Property

Net Annual Value Nil

Less: Interest on borrowed capital 1, 50,000

(Lower of ` 2,00,000 or 1,50,000 as conditions are satisfied)

Loss from House Property (1, 50,000)

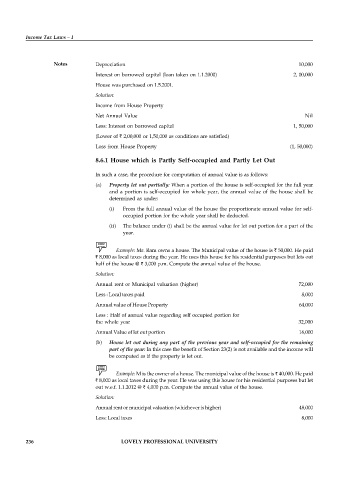

8.6.1 House which is Partly Self-occupied and Partly Let Out

In such a case, the procedure for computation of annual value is as follows:

(a) Property let out partially: When a portion of the house is self-occupied for the full year

and a portion is self-occupied for whole year, the annual value of the house shall be

determined as under:

(i) From the full annual value of the house the proportionate annual value for self-

occupied portion for the whole year shall be deducted.

(ii) The balance under (i) shall be the annual value for let out portion for a part of the

year.

Example: Mr. Ram owns a house. The Municipal value of the house is ` 50,000. He paid

` 8,000 as local taxes during the year. He uses this house for his residential purposes but lets out

half of the house @ ` 3,000 p.m. Compute the annual value of the house.

Solution:

Annual rent or Municipal valuation (higher) 72,000

Less : Local taxes paid 8,000

Annual value of House Property 64,000

Less : Half of annual value regarding self occupied portion for

the whole year 32,000

Annual Value of let out portion 16,000

(b) House let out during any part of the previous year and self-occupied for the remaining

part of the year: In this case the benefit of Section 23(2) is not available and the income will

be computed as if the property is let out.

Example: M is the owner of a house. The municipal value of the house is ` 40,000. He paid

` 8,000 as local taxes during the year. He was using this house for his residential purposes but let

out w.e.f. 1.1.2012 @ ` 4,000 p.m. Compute the annual value of the house.

Solution:

Annual rent or municipal valuation (whichever is higher) 48,000

Less: Local taxes 8,000

236 LOVELY PROFESSIONAL UNIVERSITY