Page 244 - DCOM301_INCOME_TAX_LAWS_I

P. 244

Unit 8: Income from House Property

Notes

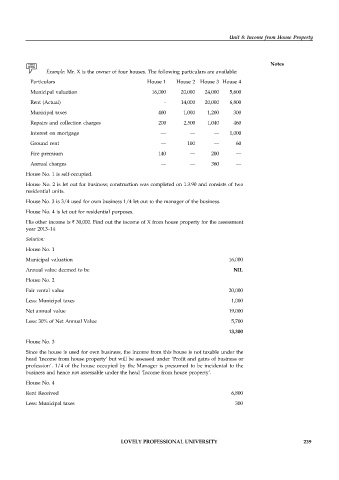

Example: Mr. X is the owner of four houses. The following particulars are available:

Particulars House 1 House 2 House 3 House 4

Municipal valuation 16,000 20,000 24,000 5,600

Rent (Actual) - 14,000 20,000 6,800

Municipal taxes 400 1,000 1,200 300

Repairs and collection charges 200 2,500 1,040 460

Interest on mortgage — — — 1,000

Ground rent — 100 — 60

Fire premium 140 — 200 —

Annual charges — — 360 —

House No. 1 is self-occupied.

House No. 2 is let out for business; construction was completed on 1.3.90 and consists of two

residential units.

House No. 3 is 3/4 used for own business 1/4 let out to the manager of the business.

House No. 4 is let out for residential purposes.

His other income is ` 30,000. Find out the income of X from house property for the assessment

year 2013–14

Solution:

House No. 1

Municipal valuation 16,000

Annual value deemed to be NIL

House No. 2

Fair rental value 20,000

Less: Municipal taxes 1,000

Net annual value 19,000

Less: 30% of Net Annual Value 5,700

13,300

House No. 3

Since the house is used for own business, the income from this house is not taxable under the

head ‘Income from house property’ but will be assessed under ‘Profit and gains of business or

profession’. 1/4 of the house occupied by the Manager is presumed to be incidental to the

business and hence not assessable under the head ‘Income from house property’.

House No. 4

Rent Received 6,800

Less: Municipal taxes 300

LOVELY PROFESSIONAL UNIVERSITY 239