Page 261 - DCOM301_INCOME_TAX_LAWS_I

P. 261

Income Tax Laws – I

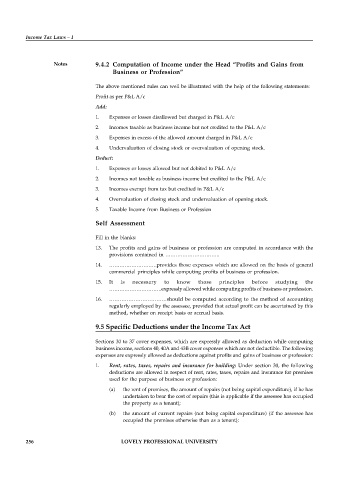

Notes 9.4.2 Computation of Income under the Head “Profits and Gains from

Business or Profession”

The above mentioned rules can well be illustrated with the help of the following statements:

Profit as per P&L A/c

Add:

1. Expenses or losses disallowed but charged in P&L A/c

2. Incomes taxable as business income but not credited to the P&L A/c

3. Expenses in excess of the allowed amount charged in P&L A/c

4. Undervaluation of closing stock or overvaluation of opening stock.

Deduct:

1. Expenses or losses allowed but not debited to P&L A/c

2. Incomes not taxable as business income but credited to the P&L A/c

3. Incomes exempt from tax but credited in P&L A/c

4. Overvaluation of closing stock and undervaluation of opening stock.

5. Taxable Income from Business or Profession

Self Assessment

Fill in the blanks:

13. The profits and gains of business or profession are computed in accordance with the

provisions contained in …………………………..

14. ……………………….provides those expenses which are allowed on the basis of general

commercial principles while computing profits of business or profession.

15. It is necessary to know those principles before studying the

………………………….expressly allowed while computing profits of business or profession.

16. ……………………………should be computed according to the method of accounting

regularly employed by the assessee, provided that actual profit can be ascertained by this

method, whether on receipt basis or accrual basis.

9.5 Specific Deductions under the Income Tax Act

Sections 30 to 37 cover expenses, which are expressly allowed as deduction while computing

business income, sections 40, 40A and 43B cover expenses which are not deductible. The following

expenses are expressly allowed as deductions against profits and gains of business or profession:

1. Rent, rates, taxes, repairs and insurance for building: Under section 30, the following

deductions are allowed in respect of rent, rates, taxes, repairs and insurance for premises

used for the purpose of business or profession:

(a) the rent of premises, the amount of repairs (not being capital expenditure), if he has

undertaken to bear the cost of repairs (this is applicable if the assessee has occupied

the property as a tenant);

(b) the amount of current repairs (not being capital expenditure) (if the assessee has

occupied the premises otherwise than as a tenant);

256 LOVELY PROFESSIONAL UNIVERSITY