Page 262 - DCOM301_INCOME_TAX_LAWS_I

P. 262

Unit 9: Income under the Head Business and Profession

(c) any sum on account of land revenue, local rates or municipal taxes; and Notes

(d) amount of any premium in respect of insurance against risk of damage or destruction

of the premises.

Applications of section 43B: Land revenue, local rates or municipal taxes are deductible

subject to the conditions as specified by section 43B.

Did u know? In cases where the assessee uses the premises partly for his business or

professional purposes and partly for other purposes the deduction allowable under this

section is a sum proportionate to that part of the expenses which are attributable to the

premises used for business or professional purposes.

2. Repairs and insurance of machinery, plant and furniture: The expenditure incurred on

current repairs (not being capital expenditure) and insurance in respect of plant, machinery

and furniture used for business purposes is allowable as deduction under section 31.

3. Depreciation: Depreciation shall be determined according to the provisions of section 32.

Conditions for claiming depreciation: In order to avail depreciation, one should satisfy the

following conditions:

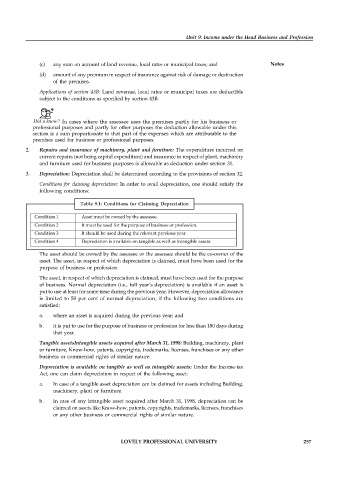

Table 9.1: Conditions for Claiming Depreciation

Condition 1 Asset must be owned by the assessee.

Condition 2 It must be used for the purpose of business or profession.

Condition 3 It should be used during the relevant previous year.

Condition 4 Depreciation is available on tangible as well as intangible assets.

The asset should be owned by the assessee or the assessee should be the co-owner of the

asset. The asset, in respect of which depreciation is claimed, must have been used for the

purpose of business or profession.

The asset, in respect of which depreciation is claimed, must have been used for the purpose

of business. Normal depreciation (i.e., full year’s depreciation) is available if an asset is

put to use at least for some time during the previous year. However, depreciation allowance

is limited to 50 per cent of normal depreciation, if the following two conditions are

satisfied:

a. where an asset is acquired during the previous year; and

b. it is put to use for the purpose of business or profession for less than 180 days during

that year.

Tangible assetsIntangible assets acquired after March 31, 1998: Building, machinery, plant

or furniture, Know-how, patents, copyrights, trademarks, licenses, franchises or any other

business or commercial rights of similar nature.

Depreciation is available on tangible as well as intangible assets: Under the Income-tax

Act, one can claim depreciation in respect of the following asset:

a. In case of a tangible asset depreciation can be claimed for assets including Building,

machinery, plant or furniture.

b. In case of any intangible asset acquired after March 31, 1998, depreciation can be

claimed on assets like Know-how, patents, copyrights, trademarks, licenses, franchises

or any other business or commercial rights of similar nature.

LOVELY PROFESSIONAL UNIVERSITY 257