Page 145 - DCOM302_MANAGEMENT_ACCOUNTING

P. 145

Management Accounting

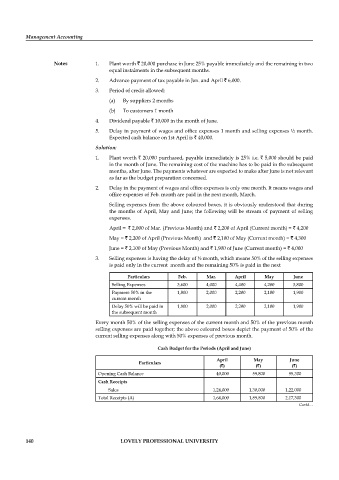

Notes 1. Plant worth ` 20,000 purchase in June 25% payable immediately and the remaining in two

equal instalments in the subsequent months.

2. Advance payment of tax payable in Jan. and April ` 6,000.

3. Period of credit allowed:

(a) By suppliers 2 months

(b) To customers 1 month

4. Dividend payable ` 10,000 in the month of June.

5. Delay in payment of wages and office expenses 1 month and selling expenses ½ month.

Expected cash balance on 1st April is ` 40,000.

Solution:

1. Plant worth ` 20,000 purchased, payable immediately is 25% i.e. ` 5,000 should be paid

in the month of June. The remaining cost of the machine has to be paid in the subsequent

months, after June. The payments whatever are expected to make after June is not relevant

as far as the budget preparation concerned.

2. Delay in the payment of wages and office expenses is only one month. It means wages and

office expenses of Feb. month are paid in the next month, March.

Selling expenses from the above coloured boxes, it is obviously understood that during

the months of April, May and June; the following will be stream of payment of selling

expenses.

April = ` 2,000 of Mar. (Previous Month) and ` 2,200 of April (Current month) = ` 4,200

May = ` 2,200 of April (Previous Month) and ` 2,100 of May (Current month) = ` 4,300

June = ` 2,100 of May (Previous Month) and ` 1,900 of June (Current month) = ` 4,000

3. Selling expenses is having the delay of ½ month, which means 50% of the selling expenses

is paid only in the current month and the remaining 50% is paid in the next

Particulars Feb. Mar. April May June

Selling Expenses 3,600 4,000 4,400 4,200 3,800

Payment 50% in the 1,800 2,000 2,200 2,100 1,900

current month

Delay 50% will be paid in 1,800 2,000 2,200 2,100 1,900

the subsequent month

Every month 50% of the selling expenses of the current month and 50% of the previous month

selling expenses are paid together; the above coloured boxes depict the payment of 50% of the

current selling expenses along with 50% expenses of previous month.

Cash Budget for the Periods (April and June)

April May June

Particulars

(`) (`) (`)

Opening Cash Balance 40,000 59,800 95,300

Cash Receipts

Sales 1,24,000 1,30,000 1,22,000

Total Receipts (A) 1,64,000 1,89,800 2,17,300

Contd…

140 LOVELY PROFESSIONAL UNIVERSITY