Page 16 - DCOM302_MANAGEMENT_ACCOUNTING

P. 16

Unit 2: Understanding Corporate Financial Statements

Advertising 8,650 Notes

Telephone 2,700

Travel and Entertainment 2,550

Dues & Subscriptions 1,100

Interest Paid 2,140

Repairs & Maintenance 1,250

Taxes & Licenses 11,700

Total Expenses 133,290

Net Income ` 60,110

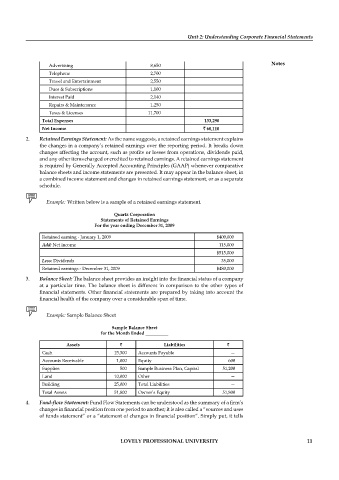

2. Retained Earnings Statement: As the name suggests, a retained earnings statement explains

the changes in a company’s retained earnings over the reporting period. It breaks down

changes affecting the account, such as profits or losses from operations, dividends paid,

and any other items charged or credited to retained earnings. A retained earnings statement

is required by Generally Accepted Accounting Principles (GAAP) whenever comparative

balance sheets and income statements are presented. It may appear in the balance sheet, in

a combined income statement and changes in retained earnings statement, or as a separate

schedule.

Example: Written below is a sample of a retained earnings statement.

Quartz Corporation

Statements of Retained Earnings

For the year ending December 31, 2009

Retained earning - January 1, 2009 $400,000

Add: Net income 115,000

$515,000

Less: Dividends 35,000

Retained earnings - December 31, 2009 $480,000

3. Balance Sheet: The balance sheet provides an insight into the financial status of a company

at a particular time. The balance sheet is different in comparison to the other types of

financial statements. Other financial statements are prepared by taking into account the

financial health of the company over a considerable span of time.

Example: Sample Balance Sheet

Sample Balance Sheet

for the Month Ended __________

Assets ` Liabilities `

Cash 15,300 Accounts Payable —

Accounts Receivable 1,000 Equity 600

Supplies 500 Sample Business Plan, Capital 51,200

Land 10,000 Other —

Building 25,000 Total Liabilities —

Total Assets 51,800 Owner’s Equity 51,800

4. Fund-fl ow Statement: Fund Flow Statements can be understood as the summary of a fi rm’s

changes in financial position from one period to another; it is also called a “sources and uses

of funds statement” or a “statement of changes in financial position”. Simply put, it tells

LOVELY PROFESSIONAL UNIVERSITY 11