Page 225 - DCOM302_MANAGEMENT_ACCOUNTING

P. 225

Management Accounting

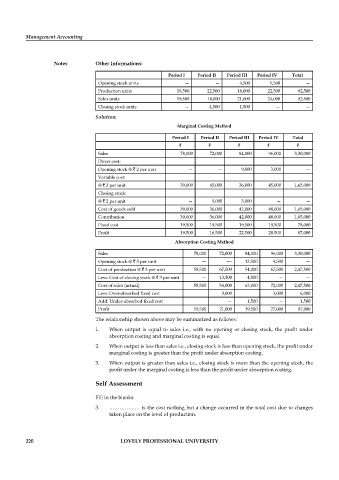

Notes Other Informations:

Period I Period II Period III Period IV Total

Opening stock units — — 4,500 1,500 —

Production units 19,500 22,500 18,000 22,500 82,500

Sales units 19,500 18,000 21,000 24,000 82,500

Closing stock units — 4,500 1,500 — —

Solution:

Marginal Costing Method

Period I Period II Period III Period IV Total

` ` ` ` `

Sales 78,000 72,000 84,000 96,000 3,30,000

Direct cost:

Opening stock @ ` 2 per unit — — 9,000 3,000 —

Variable cost:

@ ` 2 per unit 39,000 45,000 36,000 45,000 1,65,000

Closing stock:

@ ` 2 per unit — 9,000 3,000 — —

Cost of goods sold 39,000 36,000 42,000 48,000 1,65,000

Contribution 39,000 36,000 42,000 48,000 1,65,000

Fixed cost 19,500 19,500 19,500 19,500 78,000

Profi t 19,500 16,500 22,500 28,500 87,000

Absorption Costing Method

Sales 78,000 72,000 84,000 96,000 3,30,000

Opening stock @ ` 3 per unit — —- 13,500 4,500 —

Cost of production @ ` 3 per unit 58,500 67,500 54,000 67,500 2,47,500

Less: Cost of closing stock @ ` 3 per unit — 13,500 4,500 — —

Cost of sales (actual) 58,500 54,000 63,000 72,000 2,47,500

Less: Over-absorbed fi xed cost 3,000 3,000 6,000

Add: Under-absorbed fi xed cost — 1,500 — 1,500

Profi t 19,500 21,000 19,500 27,000 87,000

The relationship shown above may be summarized as follows:

1. When output is equal to sales i.e., with no opening or closing stock, the profi t under

absorption costing and marginal costing is equal.

2. When output is less than sales i.e., closing stock is less than opening stock, the profi t under

marginal costing is greater than the profit under absorption costing.

3. When output is greater than sales i.e., closing stock is more than the opening stock, the

profit under the marginal costing is less than the profit under absorption costing.

Self Assessment

Fill in the blanks:

3. ……………… is the cost nothing but a change occurred in the total cost due to changes

taken place on the level of production.

220 LOVELY PROFESSIONAL UNIVERSITY