Page 54 - DCOM302_MANAGEMENT_ACCOUNTING

P. 54

Unit 4: Ratio Analysis

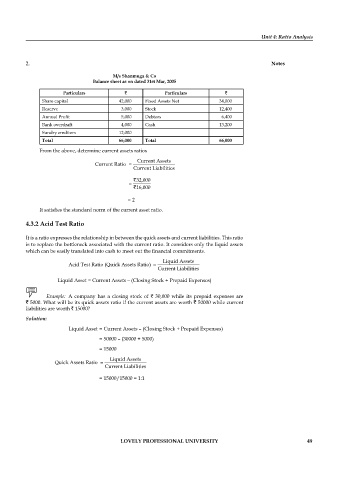

2. Notes

M/s Shanmuga & Co

Balance sheet as on dated 31st Mar, 2005

Particulars ` Particulars `

Share capital 42,000 Fixed Assets Net 34,000

Reserve 3,000 Stock 12,400

Annual Profi t 5,000 Debtors 6,400

Bank overdraft 4,000 Cash 13,200

Sundry creditors 12,000

Total 66,000 Total 66,000

From the above, determine current assets ratios

Current Assets

Current Ratio =

Current Liabilities

= `32,000

`16,000

= 2

It satisfies the standard norm of the current asset ratio.

4.3.2 Acid Test Ratio

It is a ratio expresses the relationship in between the quick assets and current liabilities. This ratio

is to replace the bottleneck associated with the current ratio. It considers only the liquid assets

which can be easily translated into cash to meet out the fi nancial commitments.

Acid Test Ratio (Quick Assets Ratio) = Liquid Assets

Current Liabilities

Liquid Asset = Current Assets – (Closing Stock + Prepaid Expenses)

Example: A company has a closing stock of ` 30,000 while its prepaid expenses are

` 5000. What will be its quick assets ratio if the current assets are worth ` 50000 while current

liabilities are worth ` 15000?

Solution:

Liquid Asset = Current Assets – (Closing Stock + Prepaid Expenses)

= 50000 – (30000 + 5000)

= 15000

Quick Assets Ratio = Liquid Assets

Current Liabilities

= 15000/15000 = 1:1

LOVELY PROFESSIONAL UNIVERSITY 49