Page 55 - DCOM302_MANAGEMENT_ACCOUNTING

P. 55

Management Accounting

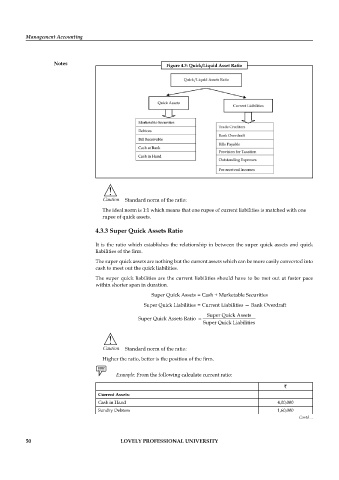

Notes Figure 4.3: Quick/Liquid Asset Ratio

!

Caution Standard norm of the ratio:

The ideal norm is 1:1 which means that one rupee of current liabilities is matched with one

rupee of quick assets.

4.3.3 Super Quick Assets Ratio

It is the ratio which establishes the relationship in between the super quick assets and quick

liabilities of the fi rm.

The super quick assets are nothing but the current assets which can be more easily converted into

cash to meet out the quick liabilities.

The super quick liabilities are the current liabilities should have to be met out at faster pace

within shorter span in duration.

Super Quick Assets = Cash + Marketable Securities

Super Quick Liabilities = Current Liabilities — Bank Overdraft

Super Quick Assets Ratio = Super Quick Assets

Super Quick Liabilities

!

Caution Standard norm of the ratio:

Higher the ratio, better is the position of the fi rm.

Example: From the following calculate current ratio:

`

Current Assets:

Cash in Hand 4,00,000

Sundry Debtors 1,60,000

Contd…

50 LOVELY PROFESSIONAL UNIVERSITY