Page 99 - DCOM302_MANAGEMENT_ACCOUNTING

P. 99

Management Accounting

Notes Credit-What goes out? Sold fixed asset is going out of the fi rm.

Cash A/c Dr `24,000

To Fixed Assets A/c `24,000

Entry for Profit on the sale of the transaction:

Fixed Assets A/c Dr ` 4,000

To Profit on sale A/c ` 4,000

In the next step, the earned profit during the sale of the fixed asset should be transferred to

the Profit & Loss a/c

Profit on sale of the Fixed Assets A/c ` 4,000

To Profit & Loss A/c ` 4,000

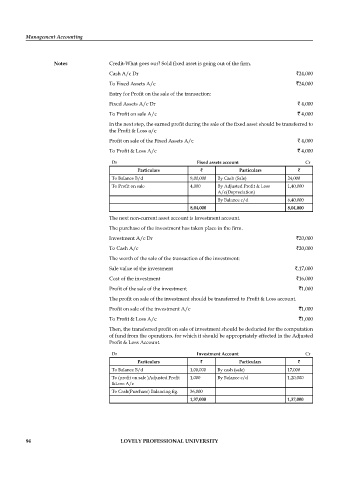

Dr Fixed assets account Cr

Particulars ` Particulars `

To Balance B/d 8,00,000 By Cash (Sale) 24,000

To Profit on sale 4,000 By Adjusted Profit & Loss 1,40,000

A/c(Depreciation)

By Balance c/d 6,40,000

8,04,000 8,04,000

The next non-current asset account is Investment account.

The purchase of the investment has taken place in the fi rm.

Investment A/c Dr `20,000

To Cash A/c `20,000

The worth of the sale of the transaction of the investment:

Sale value of the investment `,17,000

Cost of the investment `16,000

Profit of the sale of the investment `1,000

The profit on sale of the investment should be transferred to Profit & Loss account.

Profit on sale of the investment A/c `1,000

To Profit & Loss A/c `1,000

Then, the transferred profit on sale of investment should be deducted for the computation

of fund from the operations, for which it should be appropriately effected in the Adjusted

Profit & Loss Account.

Dr Investment Account Cr

Particulars ` Particulars `

To Balance B/d 1,00,000 By cash (sale) 17,000

To (profit on sale )Adjusted Profi t 1,000 By Balance c/d 1,20,000

&Loss A/c

To Cash(Purchase) Balancing fi g. 36,000

1,37,000 1,37,000

94 LOVELY PROFESSIONAL UNIVERSITY