Page 116 - DMGT405_FINANCIAL%20MANAGEMENT

P. 116

Financial Management

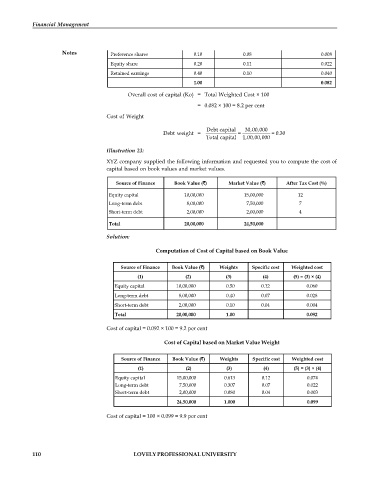

Source of Finance Weights Specific Cost (%) Weighted Cost

Debt 0.30 0.04 0.012

Notes Preference shares 0.10 0.08 0.008

Equity share 0.20 0.11 0.022

Retained earnings 0.40 0.10 0.040

1.00 0.082

Overall cost of capital (Ko) = Total Weighted Cost × 100

= 0.082 × 100 = 8.2 per cent

Cost of Weight

Debt capital 30,00,000

Debt weight = = = 0.30

Total capital 1,00,00,000

Illustration 23:

XYZ company supplied the following information and requested you to compute the cost of

capital based on book values and market values.

Source of Finance Book Value ( ) Market Value ( ) After Tax Cost (%)

Equity capital 10,00,000 15,00,000 12

Long-term debt 8,00,000 7,50,000 7

Short-term debt 2,00,000 2,00,000 4

Total 20,00,000 24,50,000

Solution:

Computation of Cost of Capital based on Book Value

Source of Finance Book Value ( ) Weights Specific cost Weighted cost

(1) (2) (3) (4) (5) = (3) × (4)

Equity capital 10,00,000 0.50 0.12 0.060

Long-term debt 8,00,000 0.40 0.07 0.028

Short-term debt 2,00,000 0.10 0.04 0.004

Total 20,00,000 1.00 0.092

Cost of capital = 0.092 × 100 = 9.2 per cent

Cost of Capital based on Market Value Weight

Source of Finance Book Value ( ) Weights Specific cost Weighted cost

(1) (2) (3) (4) (5) = (3) × (4)

Equity capital 15,00,000 0.613 0.12 0.074

Long-term debt 7,50,000 0.307 0.07 0.022

Short-term debt 2,00,000 0.080 0.04 0.003

24,50,000 1.000 0.099

Cost of capital = 100 × 0.099 = 9.9 per cent

110 LOVELY PROFESSIONAL UNIVERSITY