Page 117 - DMGT405_FINANCIAL%20MANAGEMENT

P. 117

Unit 6: Cost of Capital

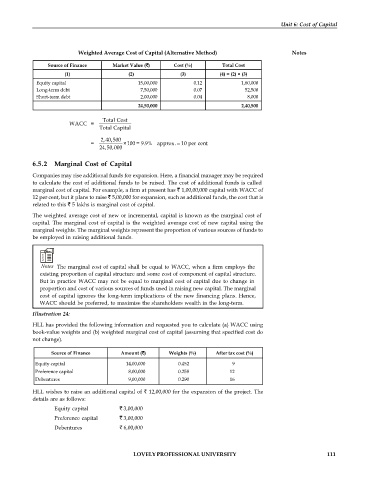

Weighted Average Cost of Capital (Alternative Method) Notes

Source of Finance Market Value ( ) Cost (%) Total Cost

(1) (2) (3) (4) = (2) × (3)

Equity capital 15,00,000 0.12 1,80,000

Long-term debt 7,50,000 0.07 52,500

Short-term debt 2,00,000 0.04 8,000

24,50,000 2,40,500

Total Cost

WACC =

Total Capital

2,40,500

= ×100 = 9.9% approx. 10 per cent

24,50,000

6.5.2 Marginal Cost of Capital

Companies may rise additional funds for expansion. Here, a financial manager may be required

to calculate the cost of additional funds to be raised. The cost of additional funds is called

marginal cost of capital. For example, a firm at present has 1,00,00,000 capital with WACC of

12 per cent, but it plans to raise 5,00,000 for expansion, such as additional funds, the cost that is

related to this 5 lakhs is marginal cost of capital.

The weighted average cost of new or incremental, capital is known as the marginal cost of

capital. The marginal cost of capital is the weighted average cost of new capital using the

marginal weights. The marginal weights represent the proportion of various sources of funds to

be employed in raising additional funds.

Notes The marginal cost of capital shall be equal to WACC, when a firm employs the

existing proportion of capital structure and some cost of component of capital structure.

But in practice WACC may not be equal to marginal cost of capital due to change in

proportion and cost of various sources of funds used in raising new capital. The marginal

cost of capital ignores the long-term implications of the new financing plans. Hence,

WACC should be preferred, to maximise the shareholders wealth in the long-term.

Illustration 24:

HLL has provided the following information and requested you to calculate (a) WACC using

book-value weights and (b) weighted marginal cost of capital (assuming that specified cost do

not change).

Source of Finance Amount ( ) Weights (%) After tax cost (%)

Equity capital 14,00,000 0.452 9

Preference capital 8,00,000 0.258 12

Debentures 9,00,000 0.290 16

HLL wishes to raise an additional capital of 12,00,000 for the expansion of the project. The

details are as follows:

Equity capital 3,00,000

Preference capital 3,00,000

Debentures 6,00,000

LOVELY PROFESSIONAL UNIVERSITY 111